The EUR/USD pair's bounce gains were capped as Forex investors temporarily abandoned the dollar by testing the 1.1820 resistance level before stabilizing around 1.1810 at the beginning of Tuesday's trading. Those gains did not take the currency pair out of the sharp descending channel that pushed it towards its lowest level in four months when it tested the support level of 1.1704 during last week’s trading. I still think that the EUR gains will be temporary and subject to selling again as the European Union continues to adhere to COVID restrictions. Besides this, the European Central Bank (ECB) recently accelerated the pace of bond purchases under the Quantitative Easing Program to provide additional support to the bloc economy.

European countries this week hastened to reduce the rise in cases of COVID-19 virus and intensify vaccinations, hoping to spare hospitals being overwhelmed by the latest deadly wave of epidemic infections. Therefore, the crushing of coronavirus patients has been relentless for hospitals in Poland, as more than 35,000 daily new infections have been recorded in the last two days and the government has ordered new restrictions to prevent large gatherings during the long Easter holiday. For his part, the French Minister of Health warned that the number of ICU patients may match the levels of a year ago.

But in a sign of the disparities from country to country, British Prime Minister Boris Johnson announced that barbershops, gyms, outdoor bars and restaurants will open next week after the country reported progress on vaccines and their recent closures. Meanwhile, the US vaccination campaign continued to accelerate, with 40 percent of the nation's adult population receiving at least one dose.

Yesterday, French Health Minister Olivier Ferrand warned that the number of COVID-19 patients in intensive care units in the country may match the level of the first crisis a year ago. Speaking on TF1 TV, he said that the country could approach ICU saturation levels in April 2020, when French ICUs detained more than 7,000 patients with the virus, and many of them were in makeshift facilities because demand far exceeded the nation's ICU capacity before the pandemic.

Ferrand expressed his hope that new infections in France would reach their peak this week, thanks to the new partial closure measures. After long resistance to calls for a new lockdown, the French government has closed schools, closed all non-essential stores across the country, and imposed four-week travel restrictions.

Authorities in the Ukrainian capital, Kiev, imposed stricter restrictions after the recent spike in cases of the virus. Therefore, all schools in the city of 3 million people will be closed during the next two weeks, and only people with special permits will be allowed to use public transport.

Elsewhere, North Macedonia has postponed mass immunization amid a vaccine shortage as its hospitals fill up after record new infections and deaths with COVID-19 last week.

In Greece, which is struggling to emerge from a deep recession, most retail stores were allowed to reopen on Monday despite the continuing rise in COVID-19 infections. Lockdown measures have been in place since early November, although stores are briefly opened during the Christmas season. The prolonged lockdowns added to the pressure on the economy.

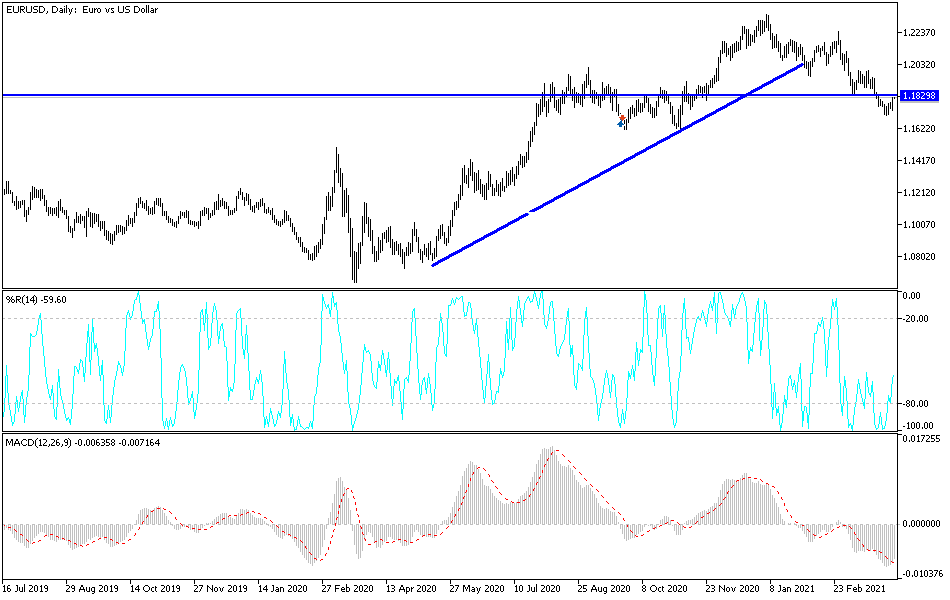

Technical analysis of the pair:

The current account of the developments of the virus outbreak in all European countries will increase the pressure on the European economy and the policy of the European Central Bank, and consequently on the price of the euro against other major currencies. In the case of the EUR/USD currency pair, its gains will remain in focus for Forex traders to consider selling, which we also support. Economic disparity and vaccination against the epidemic are in favor of the dollar's strength, and therefore, resistance levels at 1.1885, 1.1920 and 1.2000 may be the most important to consider selling at the present time.

On the upside, there will be no technical change in the path of the currency pair without breaching the psychological resistance of 1.2000 and I still prefer to sell the pair from every upward level.

The rate of change in Spanish unemployment, the Italian unemployment rate and the SENTIX Investor Confidence Index reading will be announced, along with the unemployment rate in the Eurozone. Then there will be the announcement of the number of US jobs.