The EUR/USD has been moving in an upward correction since the start of trading this week. The gains of the bulls reached the 1.2074 psychological resistance level, near which it is stable as of this writing, and the highest for the currency pair in a month-and-a-half. The recent EUR/USD gains are due to investors abandoning the dollar amid stronger risk appetite, as well as a breakthrough in European vaccinations against the coronavirus, at a time when the continent crossed the one million death mark from the epidemic.

However, it is possible that the euro will calm down a little before the European Central Bank monetary policy decision on Thursday. Ahead of the ECB announcement, the euro recorded its longest period of uninterrupted gains so far in 2021. Commenting on the recent performance of the currency pair, Jane Foley, Rabobank Forex Analyst says, “There are several fundamental factors behind the more stable tone in the currency pair which is that it originates from the Eurozone and the United States. Technical indicators indicate that a break above 1.20 could lead to a return to 1.22 and a rally could be envisioned fairly quickly, assuming stops above 1.20."

Among the factors influencing the currency pair's gains, according to many observers, are improved trends in COVID-19 infection and hospitalizations as well as an increase in the frequency of vaccinations. In addition, IHS Markit PMI surveys of the service and manufacturing sectors for the Eurozone have shown them to be more resilient by containing the coronavirus in 2021 than the European Central Bank had expected.

Some US bond yields also declined in April, which may reduce the appeal of the dollar, which has fallen broadly this month and was the worst-performing major currency last week.

Athanasios Vamvakides, Head of Forex Strategy at BofA Global Research says, “Although we remain positive towards the US dollar for the rest of the year, the short-term risks lead to further weakness. We remember the sell-off that pushed EUR/USD down to 1.235 in the first week of January. Our investor flows have turned negative once again for the US dollar, especially in the case of real money.”

At the same time, some European bond yields rose significantly, even as their US bond peers declined, which could fix the euro’s attractiveness to investors. The gap between German and US yields is improving by 16 basis points in favor of Europe's largest economy, while the same metric has increased for the Netherlands even more.

But higher bond yields and exchange rates could tighten financial conditions, which is exactly what the European Central Bank was seeking to protect when the bank said at its March meeting that it would make weekly purchases under the €1.85 trillion PEPP (Epidemic Emergency Purchase Program).

In general, it remains to be seen what the European Central Bank Board of Directors is doing about all the relevant developments and their impact on the economic outlook and inflation in the Eurozone. This uncertainty is one of the reasons why the euro has struggled to maintain its latest gains this week ahead of Thursday's decision and the press conference of Bank Governor Lagarde.

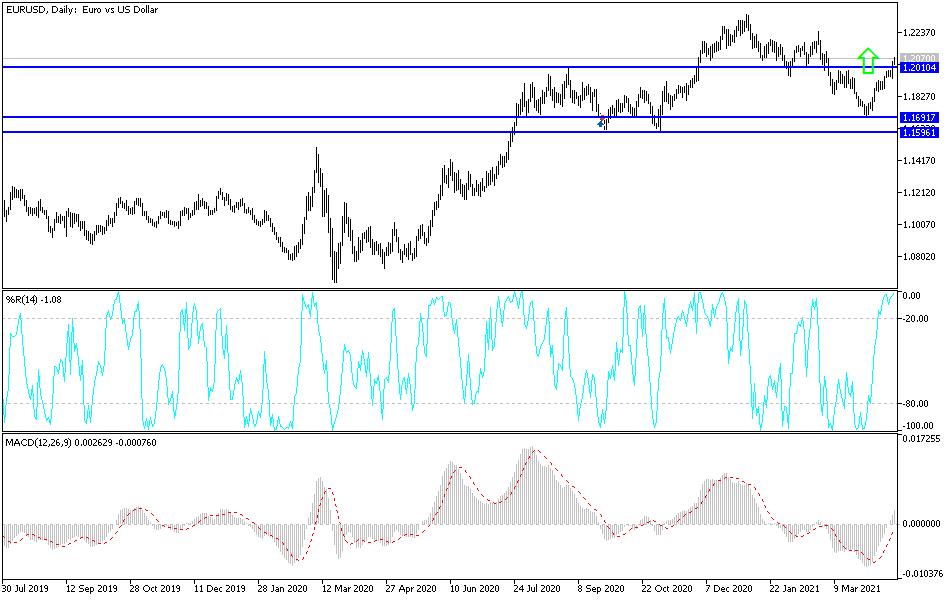

Technical analysis of the pair:

On the daily chart, the gains of the EUR/USD pushed technical indicators to overbought levels, and I expect the pair to try to maintain its gains to some extent until the European Central Bank's decisions and the statements of Governor Lagarde are announced. The current stability above the psychological resistance of 1.2000 will remain supportive of a bullish performance until new factors emerge to increase gains or profit-taking sell-offs as desired by some technical indicators. On the downside, the support level 1.1870 will remain the most important for a return to a bearish performance.

Today's economic calendar contains only the announcement of the German PPI reading. There is no significant US economic data available today.