The upward correction path for the EUR/USD is getting stronger. After optimism about European vaccinations and dovish monetary policy decisions from the US Federal Reserve, the currency pair reaped gains. The resistance level of 1.2135, its highest in two months, was long. Positive news about European vaccinations rolled in, and in this regard, the head of the German pharmaceutical company BioNTech said yesterday that more than half of the European population will have received the vaccine in the next two months, which allows governments to consider easing the lockdown rules for those who have been vaccinated.

The European Union has fallen behind Britain and the United States in the race to obtain doses of vaccines, but in recent weeks the pace of vaccinations has accelerated significantly. Ugur Sahin, whose company has developed the first widely approved dose against COVID-19 with US partner Pfizer, predicted that “50-60% of the population will receive the vaccine” by the end of June, at which point any loosening of the epidemic restrictions will affect a wide sector of the population.

He cited studies from Israel, who shared medical data about its vaccination campaign with Pfizer, which show that vaccinated people rarely develop serious illness and are less likely to transmit the virus to others.

He suggested that Europe will reach herd immunity "in July, the last by August," but he warned that children would still be among those at risk as the vaccine has so far been approved only for people over 16 years of age. While the exact threshold required to reach this critical level of immunization is still a matter of debate, experts say a level above 70% will significantly disrupt transmission of the coronavirus among the population.

The BioNTech vaccine makes up a large portion of the doses taken in North America, where it is better known as the Pfizer shot, and the European Union, which is preparing to present a massive multi-year order of 1.8 billion doses in the coming days. Accordingly, Ugur Sahin said that the data from the people who received the vaccine show that the immune response weakens over time, and it is possible that a third dose will be required. He added that studies show that the effectiveness of the BioNTech-Pfizer vaccine drops from 95% to about 91% after six months.

The euro ignored the negativity of the European economic results recently and is focusing more on the reaction to what is announced regarding the vaccination efforts and abandoning the restrictions of the epidemic.

The results of a survey by the market research group GfK showed that consumer confidence in Germany is expected to weaken in May as rising cases and the subsequent tightening of restrictions lower income expectations as well as the economic outlook. Accordingly, the Consumer Confidence Index decreased to -8.8 in May from -6.1 in April. The result was expected to improve to -3.5.

Commenting on the findings, Rolf Borkel, a consumer expert at GfK, said: “The third wave will ensure that a recovery in the domestic economy remains elusive. As in 2020, consumption will not be a pillar of the economy this year."

While the tendency to buy increased moderately, the economic outlook and the income outlook posted heavy losses in April. The Income Expectation Index dropped 13 points to 9.3 in April. The tightening of the lockdown may have reignited unemployment concerns and also raised concerns about companies moving into bankruptcy.

Contrary to income expectations, the tendency to buy has so far been resisting the third wave. The Corresponding Index rose to 17.3 points from 12.3 a month ago. This was the third consecutive increase. The index of economic expectations decreased to 7.3 points from 17.7 in the previous month. Despite the rise in exports, weak consumer spending weighs on economic growth this year.

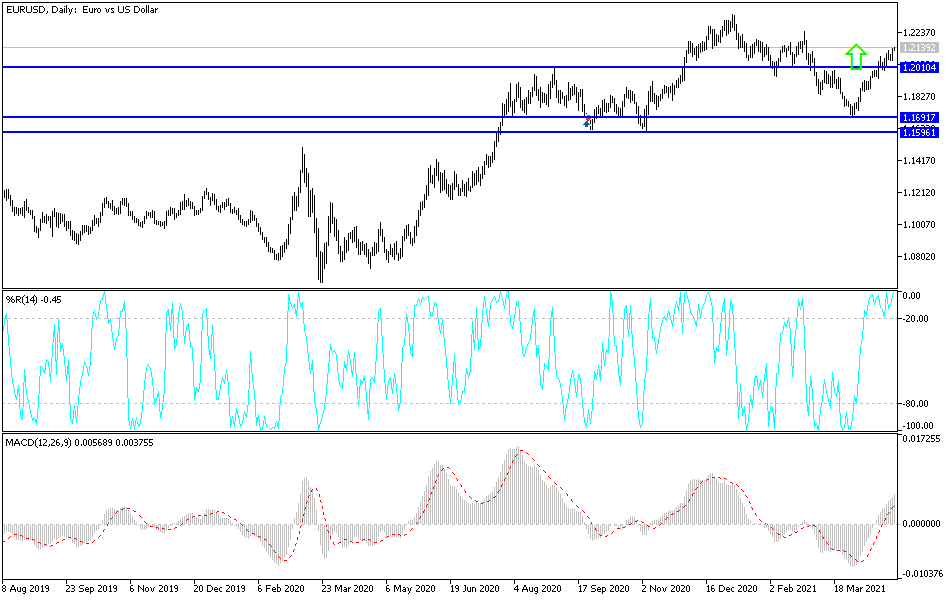

Technical analysis of the pair:

On the daily chart, the recent gains of the EUR/USD pushed the technical indicators to strong overbought levels, so I expect profit-taking to commence any time now. The best levels for selling are the resistance levels at 1.2145, 1.2220 and 1.2300. On the downside, the bears will not return to dominate the performance without breaching the 1.1860 support level.

From Germany, the consumer price reading, unemployment, and money supply in the Eurozone will be announced. In the United States, the market is expecting the reading of the GDP growth rate, weekly US jobless claims and pending home sales.