The EUR/USD had a bullish weekly closing around the 1.1980 resistance level last week, after attempts to rebound to the upside pushed the pair towards the 1.1995 resistance level. A breach of the 1.2000 psychological resistance is important for the bulls' confirmed control over the performance. The single European currency is trying to find incentives to continue the current trend. By the end of last week, inflation in the Eurozone was announced as more than its lowest level for 2020 in March, as confirmed by data from the European statistics agency Eurostat. However, the increase was tepid and left a large gap between price pressures across the bloc and those recently seen in the United States, which could keep the European Central Bank (ECB) in a political easing position for a while now.

According to what was announced, the headline Consumer Price Index in Europe rose at an annual pace of 1.3% last month, which was confirmed by the final reading of the Eurostat metric, while the important core inflation rate rose by 0.9%. Both numbers were in line with expectations for Friday's numbers, although it initially came as a moderate disappointment for economists when it was released at the end of March. Almost all countries have experienced a marked decline in most measures of economic activity in 2020, as the coronavirus and the resulting containment measures dominate the global economy, and all are expected to be erratic over the coming months as the statistical 'fundamental effects' generate significant ups and downs.

In terms of inflation, the March numbers provided potential evidence of an initial widening gap between price growth in the Eurozone and those seen in the US, which may upset the European Central Bank.

The US inflation rate rose to 2.6% in March, an indication that price growth in the US was double that seen in the Eurozone last month, and although upcoming data could change perceptions, recent numbers provide tentative evidence of a return to old economic turmoil.

The world's largest economy has been pumped with more unprecedented stimuli, including the distribution of what is not far from “helicopter money” from the government, although this is expected to ultimately benefit the global economy, including the net exporting Eurozone in general. It will not necessarily do much to some of the troubled Mediterranean economies, and any benefit that may materialize may not emerge until the gap between European and American inflation widens.

It was precisely these concerns that prompted European Central Bank Governor Christine Lagarde and other policymakers at the bank to protest against the euro’s appreciation against the dollar last year from September, most notably in January 2021, which eventually gave way to a long-term correction in the euro.

EUR/USD gains await the release of the European Central Bank's monetary policy decision on Thursday, April 22. The bank said in March that it would make purchases of government bonds under the Pandemic Emergency Purchase Program (PEPP) of 1.85 trillion euros at a much higher rate during the second quarter. The program has a limited shelf life but complements the previous and ongoing asset purchase program that purchases 20 billion monthly European government bonds. In addition to the rates charged or paid on major refinancing operations, the marginal lending facility and bank deposit facility were left unchanged at 0.00%, 0.25% and -0.50%, respectively.

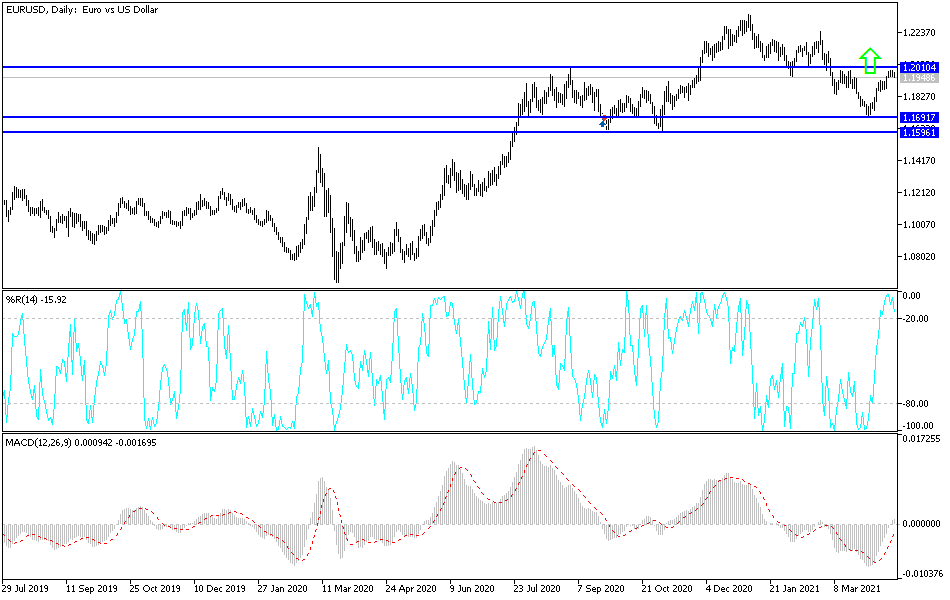

Technical analysis of the pair:

Surpassing the 1.2000 psychological resistance level will be crucial to achieve further gains, at the 1.2055, 1.2120 and 1.2200 levels. On the downside, the bears will not regain control without breaking below the 1.1850 support level. I still prefer to sell the currency pair from every upward level. Injuries, European deaths exceeding one million people, and tightening restrictions will remain pressure factors on the gains of the euro in the coming period, despite the recent breakthrough regarding vaccinations.

The currency pair does not expect any important US data. Only the current accounts in the Eurozone and the monthly report of the German central bank will be announced.