The Forex market is awaiting the Federal Reserve's announcement of its monetary policy decisions and Chairman Powell’s statements. Since the start of trading this week, the EUR/USD has been moving in a range between the resistance level of 1.2117, its highest in two months, and the support level of 1.2056, before stabilizing around 1.2088 ahead of important events in the currency market. So far, investors are turning to the euro again as they expect its value to rise against the US dollar, but the results of today's meeting of the US Federal Reserve may determine whether these bets will face a setback in the near term.

Today, Wednesday, at 19:00 GMT, the Fed will present the outcome of its April policy meeting and, at 19:30 a press conference by Governor Jerome Powell, a monthly event that can often trigger noticeable moves in the dollar's value.

Commenting on the performance of the currency pair, Michael Brown, Senior Market Analyst at CaxtonFX, said: “Sentiment has shifted towards the euro recently, as positions have become more bullish, and the EUR/USD has reached its highest level in 8 weeks, and it appears that the single European currency is in a good position for more bullishness."

Markets are expecting the US Federal Reserve to keep the rates unchanged and to maintain a long line of communication that interest rates are unlikely to rise in the near future, while acknowledging the improvement in the economic recovery. The risks faced by those betting on a higher EUR/USD are that Federal Reserve Chairman Jerome Powell and his team are showing a more optimistic tone about the US economy that investors can interpret as a sign that they are ready to start "scaling back" their quantitative easing program a year ago.

Analysts believe that this move provides bullish relief for the US dollar, which fell in April.

Accordingly, Roberto Milic, a Forex strategist at UniCredit Bank, says: “We are not expecting any major political news, but it may call for caution among the major currencies and favor more limited activity. Hence, the EUR/USD is likely to remain stuck below 1.21." The EUR/USD rose 3.0% over the course of the past month, rising to 1.2117, its highest level in 2021 at 1.2349, which was tested on January 06.

The Fed meeting comes as flow and positioning data - from individual institutions and from the CFTC - show that investors are rebuilding their exposure to the EUR's rally. Accordingly, Jane Foley, Chief Forex Strategist at Rabobank says, “The net position of the EUR speculators has risen sharply. It appears that the euro has finally diverged from the vaccine trade as the spread has increased in several European Union countries. Price activity in the EUR/USD immediately indicates that the euro may extend long positions even further.”

So the Fed meeting comes at a time of increasing “long positions” in the euro, which immediately exposes the EUR/USD to the risk of a “hawkish” surprise from the Fed, resulting in a clear exit from some of the bets that have been placed lately. In the view of Yu Na Park Hager, Forex and Emerging Markets Analyst at Commerzbank, with the differences in vaccine deployment among major economies, the Forex markets are likely to place more emphasis on relative monetary policy. In this context, the focus is on today's Fed meeting.

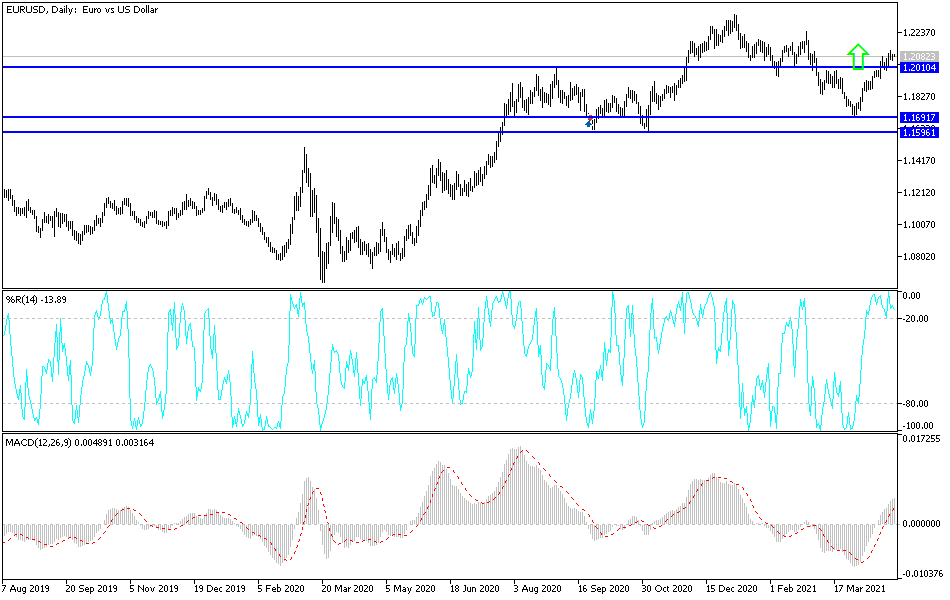

Technical analysis of the pair:

No change in performance means no change in the technical point of view, as the general trend of the EUR/USD currency pair remains bullish as long as it is stable above the psychological resistance of 1.2000, and the performance may remain in a limited range until the Federal Reserve announces its policy and statements of Chairman Jerome Powell to search for incentives to move in one direction and closer to the upside. The closest resistance levels are currently 1.2145, 1.2220 and 1.2300. The bearish reversal of the trend will be strengthened if the currency pair moves towards the support level of 1.1860. I still prefer to sell the currency pair from every upward level.