The EUR/USD has been dominated by a bearish outlook for several trading sessions in a row, stabilizing around the 4-month low support level of 1.1704. Despite the important events affecting investor sentiment, the pair is without any movement. What will the future hold? Forex investors may ask.

The currency pair has weakened from the European vaccination pace, restored economic restrictions and poor economic stimulus measures. All are factors supporting the continued domination of the bears on the performance of the EUR/USD. Even the results of economic releases are still in favor of the dollar's strength against other major currencies.

Yesterday, contrary to expectations, the inflation numbers in the Eurozone weakened for the month of March, and in the process revealed that the risk of deflation still exists in parts of the bloc even as prices rise in other countries, which justifies the accurate response to the crisis from the European Central Bank (ECB). According to official figures, inflation rose from 0.9% to 1.3% in the Eurozone during the month of March, according to Eurostat estimates, although the increase came due to the rise in energy prices, which is a temporary factor, and the number was less than the expectations of 1.4%.

In the same performance, the most important measure of core inflation - which excludes energy and food - decreased from 1.1% to 0.9% in the same month, and economists were looking to stabilize it. This latter measure is being taken with greater focus by European Central Bank policymakers because it ignores changes in energy prices as well as changes in the cost of regulated price items such as alcohol and tobacco, which could obscure or interfere with fundamental trends in inflation.

Commenting on the figures, Christoph Weil, an economist at Commerzbank said: “The inflation rate is currently severely distorted by special factors. Therefore, core inflation should be estimated more on the basis of wage growth, which has slowed significantly as a result of the recession.”

Inflation is important to economies, financial markets and central banks, which in most parts of the world are collected using interest rates and other monetary policies to achieve steady annual price growth of generally around 2% for advanced economies. The expectations indicated that the extraordinary amounts of emergency cash pumped into economies as a result of the COVID-19 closures will lead to sharp gains in inflation throughout the developed world at least, which may push some central banks to raise interest rates sooner, which they have indicated so far is likely. But while inflation has risen across the bloc in recent months while in some parts it has risen back to the 2% target for the European Central Bank, and in others, the threat of lowering inflation or even outright deflation has remained strong.

Continued stimulus on the part of the US administration contributed in the first degree to the labor market's resistance to the devastating effects of the virus. US President Joe Biden has unveiled a difficult transformation of the US economy.

In this regard, White House officials say that spending over eight years will generate millions of new jobs as the country moves away from fossil fuels and combats the risks of climate change. It is also an attempt to compete with technology and public investment by China, which has the second largest economy in the world and is rapidly gaining a dominant position over the United States. White House Press Secretary Jane Psaki stated that the plan is about "investing in America - not just modernizing our roads, railways, or bridges, but building infrastructure for the future."

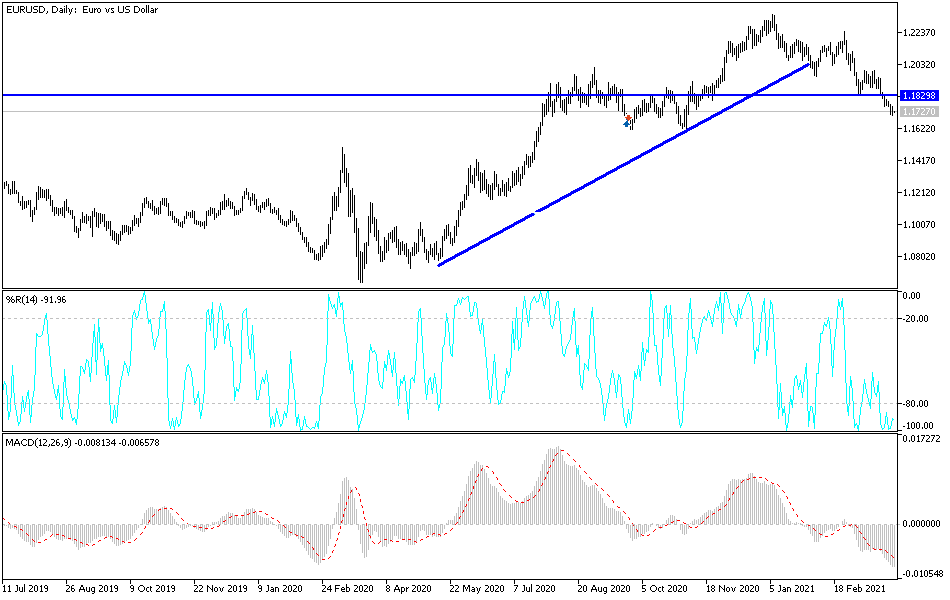

Technical analysis of the pair:

The continuing losses of the EUR/USD pushed technical indicators to strong oversold levels, but the pair lacks sufficient momentum to take advantage of the opportunity to bounce higher. European restrictions to contain the increase in infections of the coronavirus and the ongoing announcement by major European economies of COVID-19 restrictions prevent the pair from achieving what Forex traders wish. The control of the bears may push the pair towards stronger support levels, the closest of which are currently 1.1675 and 1.1590, with the last level being very ideal for buying and waiting for a correction to the upside. This correction will not succeed without testing the psychological resistance of 1.2000 as a first stage.

Variations in economic performance, stimulus and vaccination plans against the epidemic will continue to be the factors affecting the performance of the currency pair in the coming days.

The Manufacturing PMI reading for the Eurozone economies will be announced, and the major focus will be Germany's reading. From the United States, the number of weekly jobless claims, ISM Manufacturing PMI and Construction Spending Index will be announced.