The bulls are trying to maintain the stability of the EUR/USD pair above the 1.2000 psychological resistance to confirm the bullish rebound. However, as the currency pair tested the 1.2080 resistance, its highest in nearly two months, it may be subject to sell-offs and stalled gains until the European Central Bank monetary policy decisions are announced on Thursday. Indeed, the EUR/USD pair retreated to the level of 1.1998 before settling around the level of 1.2035 at the time of writing. The price action came before the European Central Bank policy update at 12:45 today, in which the bank will determine its recent views on the state of the Eurozone and its outlook, whose prospects have initially improved with trends in COVID-19 infections and indications that obtaining more vaccines can be achieved.

The bears were unable to move below 1.20 yesterday, amid a move that closely coincides with indications of an initial improvement in investor appetite for financial assets in the Eurozone. The euro’s rise against the dollar may also be supported by the spillover effects of activity in the US stock markets as international investors pushed benchmarks to further new record levels in recent weeks and largely without hedging the US dollar risks that come with those positions.

Usually, international investors who buy US stocks sell the US dollar at the same time to prevent their returns from eroding from any depreciation of the US currency. Howeve,r the dollar has risen so far this year, partly as a result of deteriorating sentiment towards the euro. Lately, however, the euro has recovered somewhat and the dollar has turned lower, while the outlook for the Eurozone economy has become at least less pessimistic, if not trending for the better.

This may mean that it is only a matter of time before stock market investors who buy dollars start selling dollars in larger quantities in order to reap the greatest possible return.

Eurozone equity markets and exchange-traded funds (ETFs) offering low cost and diversified exposure have seen a short-term and tepid increase in demand from foreign investors, according to procedures and monitoring data used by the Nomura team.

Nomura's Rochester analyst added in a research note this week that “it is too early to gauge the extent of that performance”, but if supply from foreign investors continues, the resulting inflows are likely to push the euro up in the coming weeks and months.

Germany's Supreme Court refused to issue a judicial order preventing the country from participating in the European Union Fund for Coronavirus Recovery worth 750 billion euros (more than 900 billion dollars), paving the way for the launch of the fund and joint borrowing aimed at supporting green, digital and economic growth. In this regard, the Federal Constitutional Court said that it had rejected a request for a preliminary injunction from a group that includes economics professor Bernd Locke, founder of the populist Alternative for Germany Party who has since left the party.

The group argued that the EU treaty prohibits joint borrowing supported by taxpayers in member states to support the recovery fund and spend it on projects to help bring the economy back to speed after the pandemic recession.

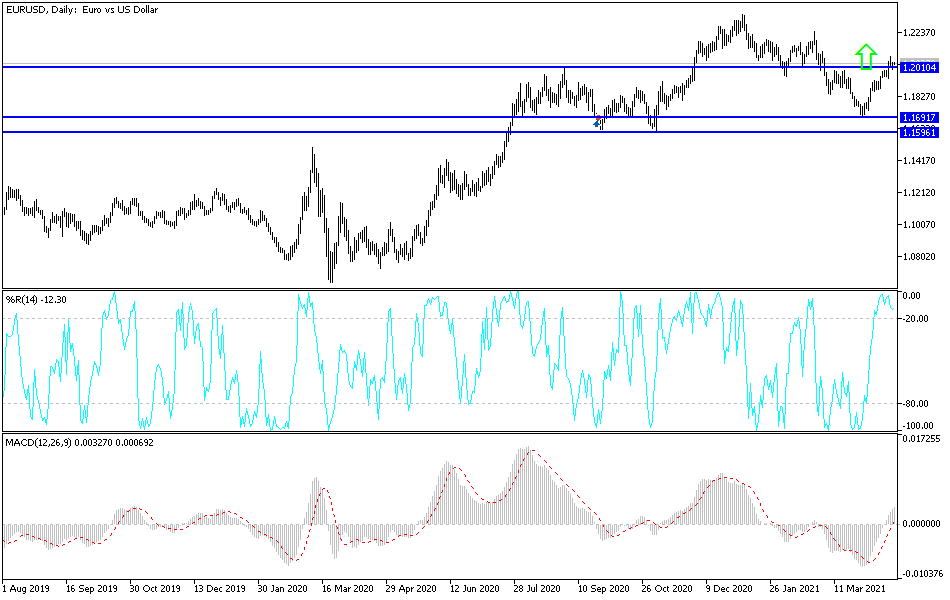

Technical analysis of the pair:

The stability of the EUR/USD around the peak psychological resistance of 1.2000 will continue to support the bullish performance and thus increase buying, especially if the European Central Bank's policy decisions come out today in support of the recent positive sentiment of the euro. The closest resistance levels for the pair are currently 1.2085, 1.2130 and 1.2210. On the downside, as I mentioned before, the 1.1860 support level will remain the most important for the bears to return to control the performance again. I still prefer to sell the currency pair from every upward level.

Focus will be on the announcement of the European Central Bank's monetary policy decisions and the statements of Governor Lagarde. From the United States, the number of US unemployed claims and existing home sales will be announced.