The EUR/USD pair's bullish performance resulted in gains that culminated in testing the 1.1915 resistance level before settling around the 1.1870 level as of this writing. Despite this performance, the EUR/USD is subject to decline again. COVID restrictions in Europe and the increase in infections, along with the slow vaccination pace and even the stimulus plans, are still pressure factors on any gains for the euro against the rest of the other major currencies.

In contrast, the US economy outperformed other global economies thanks to a combination of a rapid launch of the vaccine and a strong financial boost to the economy. This momentum will likely remain anchored after the administration confirmed Tuesday that by April 19, all adults in the United States will be invited to go ahead to get their vaccine. These developments related to ending the epidemic in the United States and the stimulus package of $1.9 trillion are reflected in economic activity. Last week, the US report saw a 916K rise in non-farm payrolls for the month of March, and improved economic sentiment echoed strong rallies in ISM and conference board surveys.

The US dollar has challenged investors and analysts alike through its first-quarter gains in 2021 and overturned the strong consensus that 2021 will be a year of decline for the currency as the world recovers from the COVID pandemic in tandem. A community survey of analysts showed an overwhelming preference for a lower dollar at the start of 2021 while the positioning data showed that speculators are betting overwhelmingly on their money against the dollar.

A spokeswoman for German Chancellor Angela Merkel supports calls for a "short and uniform lockdown" as the country grapples with a surge in coronavirus cases. German state governors, responsible for imposing and lifting the restrictions, have taken different approaches. Some limit reopening steps, others call for a tighter lockdown. Armin Laschet, the governor who also leads Merkel's party, called for a "bridge closure" for 2-3 weeks to control the infection while vaccinations are ramped up.

Merkel's spokeswoman, Ulrike Demer, says: "Every claim for a short, uniform closure is valid." She adds that the number of new cases is not particularly good, and the rise in the number of intensive care beds occupied "speaks a very clear language."

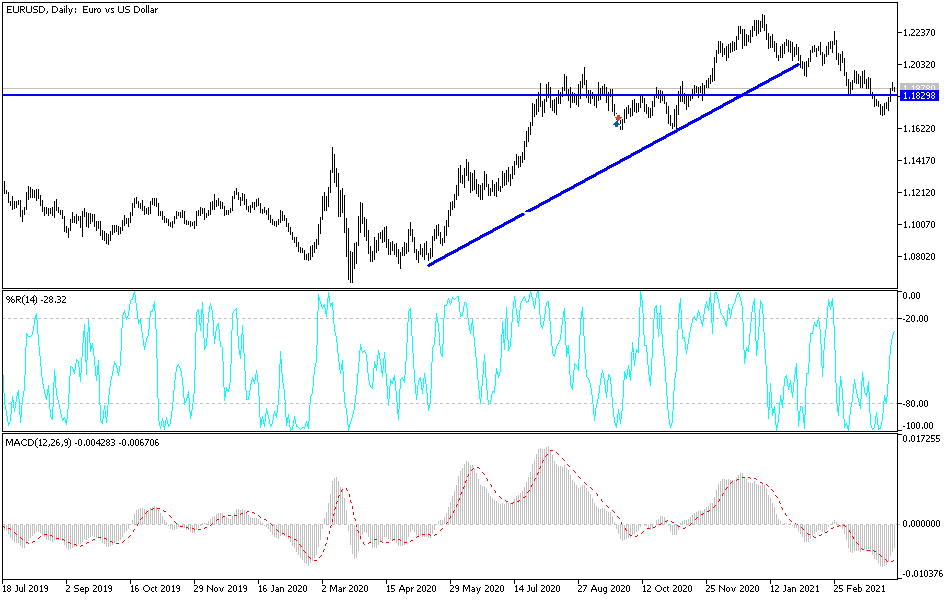

Technical analysis of the pair:

An opposing bullish channel has formed for the EUR/USD, and to strengthen the momentum, the currency pair still needs to breach the psychological resistance level of 1.2000, which requires raising the pessimistic sentiment about European restrictions and announcing more vaccination plans. I still prefer to sell the currency pair from every high. Economic disparity and the introduction of stimulus plans and even monetary policy are in favor of the strength of the US dollar. On the downside, a breach below the 1.1800 level will continue to be important for the bears to dominate their performance again.

German factory orders, the Producer Price Index in the Eurozone, and then the European Central Bank's monetary policy report will be announced. From the United States of America, the unemployed claims will be announced and later statements by Federal Reserve Chairman Jerome Powell will be announced.