Bullish View

Buy the EUR/USD and set a take-profit at 1.1850.

Add a stop loss at 1.1710 (S1 of standard pivot point).

Timeline: 1-2 days.

Bearish View

Set a sell-stop at 1.1750 and a take-profit at 1.1700 (YTD low).

Add a stop-loss at 1.1800.

The EUR/USD price held steady in early trading as the market continued to reflect on the strong US employment numbers published on Friday. It is trading at 1.1770, which is 0.50% above the lowest level this year.

Strong US Recovery

Recent numbers have pointed to a strong rebound of the US economy as the government rolls out the coronavirus vaccine and more states reopen. Last week, data by Markit and the Institute of Supply Management (ISM) revealed that the country’s manufacturing sector continued to surge in March. The figures have been above 50 for the past few months. Later today, the ISM will publish strong Non-Manufacturing PMI numbers from the US.

On Friday, the Bureau of Labour Statistics (BLS) published the relatively strong US employment numbers. In March, the economy added more than 780,000 jobs, a substantial increase from the previous 558,000. This increase was better than the median estimate of 575,000.

In the same period, the unemployment rate dropped from 6.2% to 6.0% while the average weekly hours rose from 34.6 to 34.9. The wage growth, however, declined from 0.3% to -0.1%.

Other numbers that will be released this month will be relatively strong because of the substantial stimulus offered by the US government. In March, it offered a $1.9 trillion stimulus package and Biden has already unveiled a $2.3 trillion infrastructure plan.

The EUR/USD activity will be relatively muted today since most countries in Europe are in holiday. Still, the market will be focusing on the rising US bond yields. The ten-year Treasury yield has risen to 1.72% while the 30-year yield has risen to 2.371%.

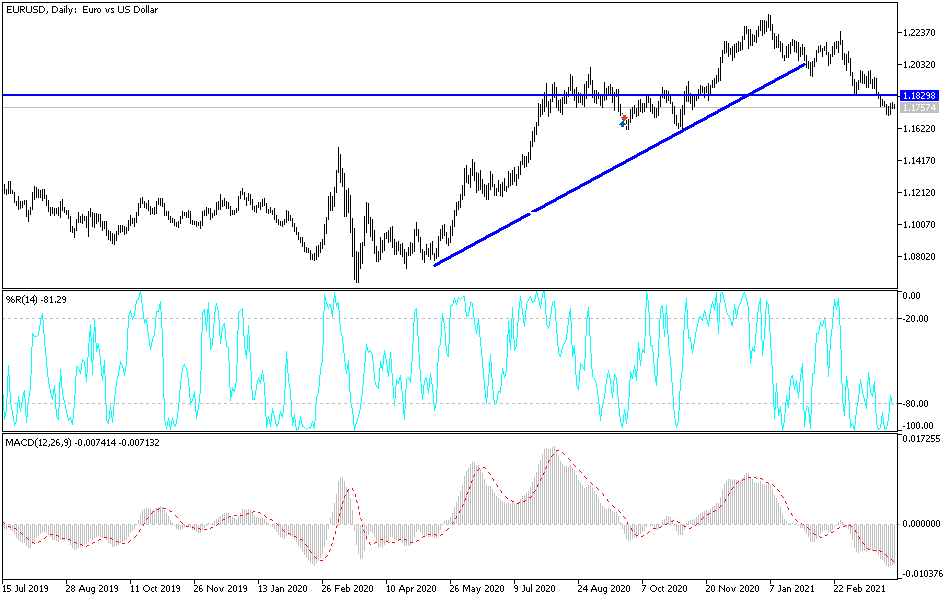

EUR/USD Technical Analysis

The EUR/USD pair is little changed today as US bond yields rise ahead of the US Non-Manufacturing PMI numbers. On the four-hour chart, the price remains slightly below the 78.6% Fibonacci retracement level at 1.1818. It is also slightly above the standard pivot point and the 15-day and 25-day weighted moving averages.

Therefore, the pair may keep rising as bulls attempt to move above last week’s high of 1.1783 and the first resistance at 1.1800. However, a drop below the pivot at 1.1752 will invalidate this trend.