Bullish View

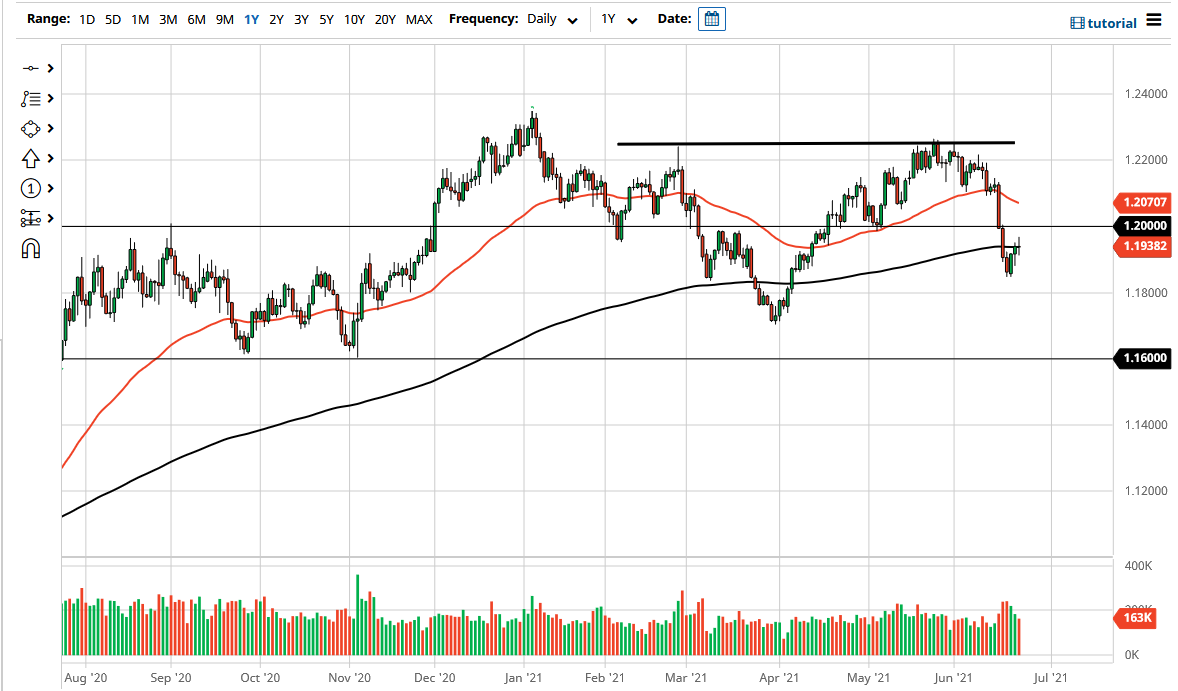

- Buy the EUR/USD after its bullish breakout.

- Set a take-profit at 1.2150 and a stop loss at 1.2080.

- Timeline: 1 day.

Bearish View

- Set a sell-stop at 1.2080 and a take-profit at 1.2000.

- Add a stop-loss at 1.2150.

The EUR/USD pair jumped to the highest level since March 3 as US bond yields retreated, with focus turning to the upcoming Federal Reserve rate decision. It rose to 1.2110 in the Asian session, which is 3.50% above its lowest level this year.

Fed Decision Ahead

The EUR/USD moved relatively sideways last week as the market focused on the European Central Bank (ECB) decision. In it, the bank left rates and quantitative easing policies intact and sounded more dovish than expected.

This week, the market will focus on the Federal Reserve, which will start its meeting on Tuesday and deliver its decision on Wednesday. This meeting will come at a time when the American economy is booming.

Corporate earnings are strong while stocks are hovering at their all-time highs. Similarly, economic numbers like inflation, employment, and business output is rising. Therefore, while the Fed will leave its interest rate unchanged, the EUR/USD will react to the overall sentiment and guidance by Jerome Powell.

Today, the pair will react mildly to the latest German sentiment and US durable goods order numbers. In Germany, data by the IFO Institute is expected to show that the Business Climate Index rose from 96.6 in March to 97.8 in April.

Similarly, the current assessment is expected to rise from 93.0 to 94.4 while business expectations are expected to rise from 100.4 to 101.3. This optimism will mostly be because of the ongoing vaccination drive and hopes that the German economy will recover.

The EUR/USD will also react to the latest US durable goods orders. The market expects that the headline durable goods orders rose from -1.2% in February to 2.5% in March. They also see the core durable goods orders rising by 1.6%.

EUR/USD Forecast

The four-hour chart shows that the EUR/USD pair has been in an overall bullish trend in the past few weeks. This has seen it rise to the 23.6% Fibonacci retracement level. The uprend is also being supported by the 14-day and 7-day smoothed moving average (SMMA). It has also formed an ascending channel. It is attempting to move to the upper side of this channel. Therefore, the pair is likely to keep rising as bulls target the upper side of this channel at 1.2150.