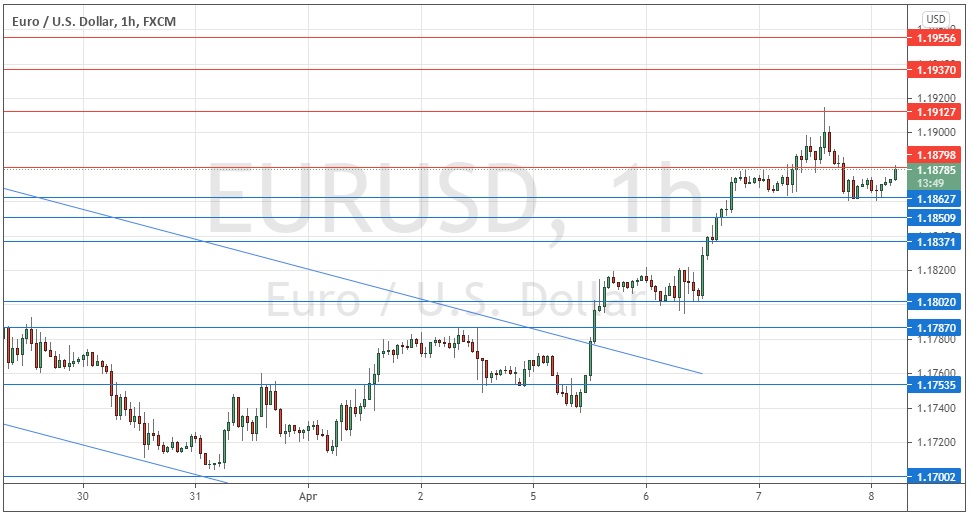

Last Tuesday’s EUR/USD signals were not triggered, as there was no bearish price action when the resistances level identified between 1.1837 and 1.1867 were first reached.

Today’s EUR/USD Signals

Risk 0.75%.

Trades must be taken between 8am and 5pm London time today only.

Short Trade Ideas

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1880, 1.1913, 1.1937, or 1.1956.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1863, 1.1851, 1.1837, or 1.1802.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

EUR/USD Analysis

I wrote last Tuesday that the price seemed to now be well supported at 1.1802 and had broken out of the former bearish price channel.

I thought that taking a long trade from this supportive bounce off 1.1802 and closely monitoring it on a short time frame would be the best trade of the day. This was a good call as the bullish push which began from this support level continued firmly over the day, with the price closing in New York a few pips below the 1.1900 handle.

It now seems that the euro is one of the strongest major currencies, so it has been rising firmly against a U.S. dollar which is beginning to weaken after some weeks of strong advances.

The euro will be in focus today anyway as the ECB will be releasing its monthly policy meeting minutes later today, so it is worth paying attention to this currency pair now.

There is residual bullish momentum and support levels have been holding very firm, but we also see a strong reversal from the resistance level at 1.1913 and new lower resistance forming at 1.1880.

The key technical developments to watch for today are whether the resistance at 1.1880 continues to hold, as it has done during the Asian session – if the price gets established above it, we should see another test of 1.1913 quickly.

Alternatively, if the price breaks below 1.1863 that would be a bearish sign, but I would be more excited by a break above 1.1880 as the line of least resistance still looks likely to be upwards to a long trade will probably have further to run.

Regarding either the EUR, the European Central Bank will release its Monetary Policy Meetings Account at 12:30pm London time. There is nothing of high importance scheduled today concerning the USD.