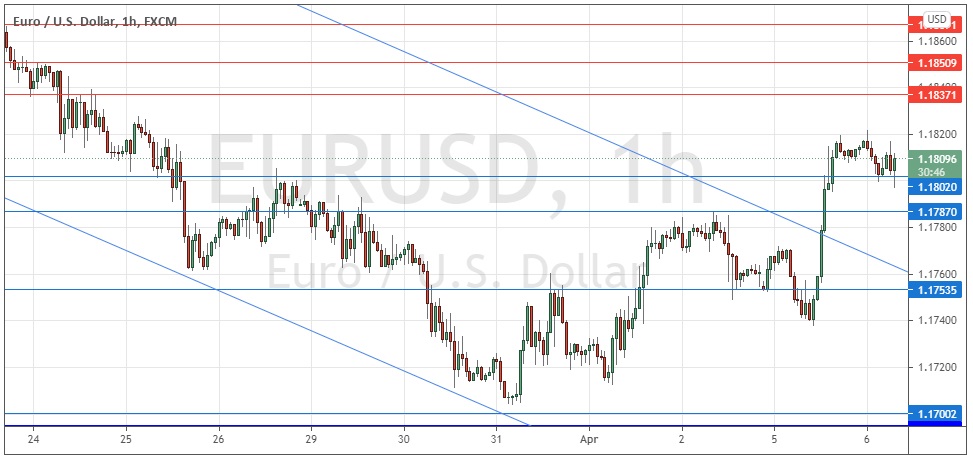

Last Thursday’s EUR/USD signals were not triggered, as there was no bearish price action when the resistance level identified at 1.1760 was first reached.

Today’s EUR/USD Signals

Risk 0.75%.

Trades may only be entered before 5pm London time today.

Short Trade Ideas

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1837, 1.1851, or 1.1867.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1802, 1.1787, 1.1754, or 1.1700.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

EUR/USD Analysis

I wrote last Thursday that although the symmetrical bearish price channel was holding and the long-term bearish momentum looked set to continue, bears might need to be cautious over the short term and expect a further bullish retracement, as we had this cluster of support levels between 1.1700 and 1.1685 plus the round number confluent at 1.1700, which may take some time to break down or even produce a bullish reversal.

Therefore, I saw the best approach as to wait for a bullish retracement to the clear resistance level at 1.1760 and be ready to enter short if there is a bearish reversal there.

I was correct to warn about the supportive confluence below 1.1700 as it did produce a relatively strong bullish reversal which appears to be holding up, especially as the price seems to now be well supported at 1.1802 and has broken out of the former bearish price channel.

The euro has been relatively weak but that may be changing now.

Bulls may not have very far to run, but for today, it looks like taking a long trade from this supportive bounce off 1.1802 and closely monitoring it on a short time frame will be the best trade, at least in the first half of today’s London session.

A bearish reversal at 1.1837 could also be an interesting signal for a short trade later, or at least to exit any long based from the support level at 1.1802.

There is nothing of high importance due today regarding either the EUR or the USD.