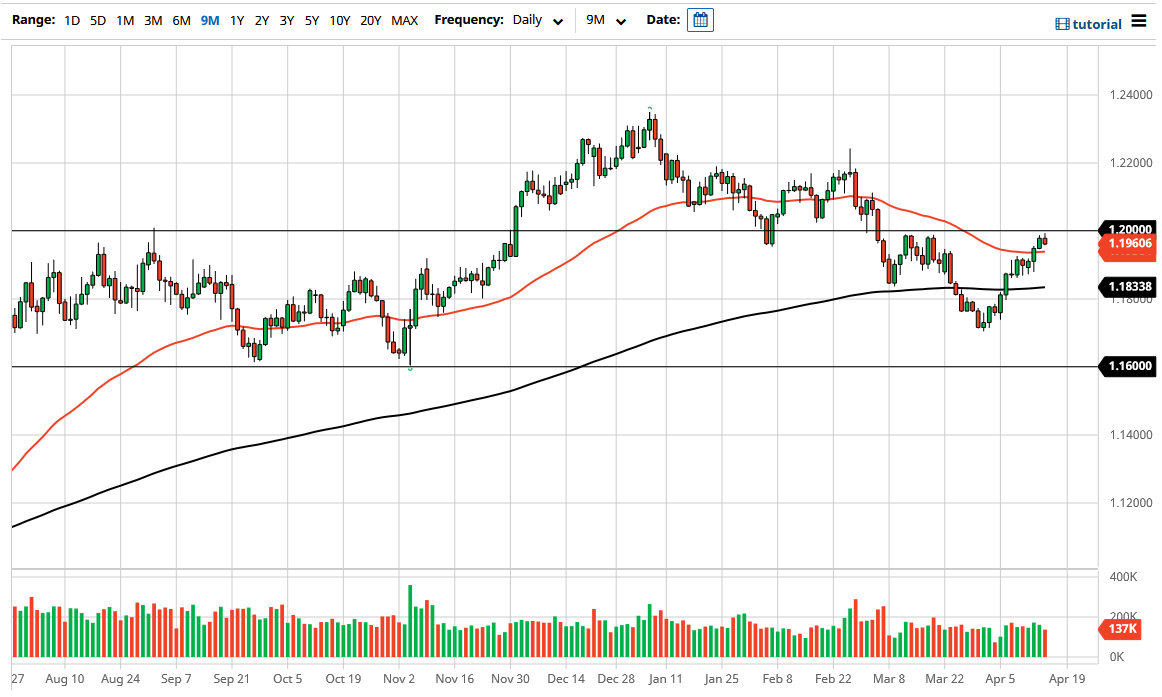

The Euro initially rallied during the trading session on Monday but then gave back the gains just below the one point to zero level to show signs of negativity. The question now is whether or not we can break down below the 50 day EMA, as it could open up quite a bit of downward pressure. If we were to break down below the 50 day EMA, then it is likely that the market will go looking towards the support area around the 1.1850 level. After that, then it is possible that we could go down to the 200 day EMA which of course is an indicator that a lot of longer-term traders will pay close attention to.

Breaking down below the 200 day EMA then more or less sends this market much lower. The 1.16 level underneath is a massive support level that people will pay close attention to. Breaking down below there could be a very negative sign for the Euro and perhaps in the currency much lower. That being said, we have a lot of work to do before we get anywhere near there, and we would obviously need to see massive strength in the greenback overall.

If we turn around and break above the 1.20 level, that could send this market much higher, as it would be a major breakout, opening up the possibility of the Euro going towards the 1.22 handle, perhaps even the 1.23 handle. It is worth noting that the market is very noisy typically, and I do think that is going to be difficult to get overly aggressive in this market, but it is most certainly worth trading to the downside if we break down below the 50 day EMA, although I think you need to be cautious about putting a huge positions on.

In general, this is going to move based upon a huge list of issues, not the least of which will be the fact that the European Union struggles to vaccinate its population, while the United States seemingly has no issues. Furthermore, during the trading session on Thursday retail sales came out of the United States much stronger than anticipated, so this could only serve to exacerbate the differential between the two areas. Because of this, it is likely that we will continue to move on headlines in a very choppy manner more than anything else.