April was a very strong month for the euro, and I do believe that we will continue to see a bit of continuation going forward. After all, we have broken through a relatively significant downtrend line and we also have the FOMC meeting and statement out of the way. It appears that Jerome Powell is still going to keep the spigot open on liquidity measures, and that should continue to work against the value of the greenback. If that is the case, then the euro, by extension, should get a bit of a boost due to the fact that it is quite often thought of as the “anti-dollar.”

Further driving this pair potentially higher is the fact that we are starting to see signs of life in the European Union again, as the lockdown is starting to slow down a bit. Furthermore, bond yields in the EU are starting to rise, so the interest rate differential may tighten off a bit. If that continues to be the case, then it makes sense that this pair will go higher. Add to that the fact that the United States is flooding the market with liquidity, we should see this market rise.

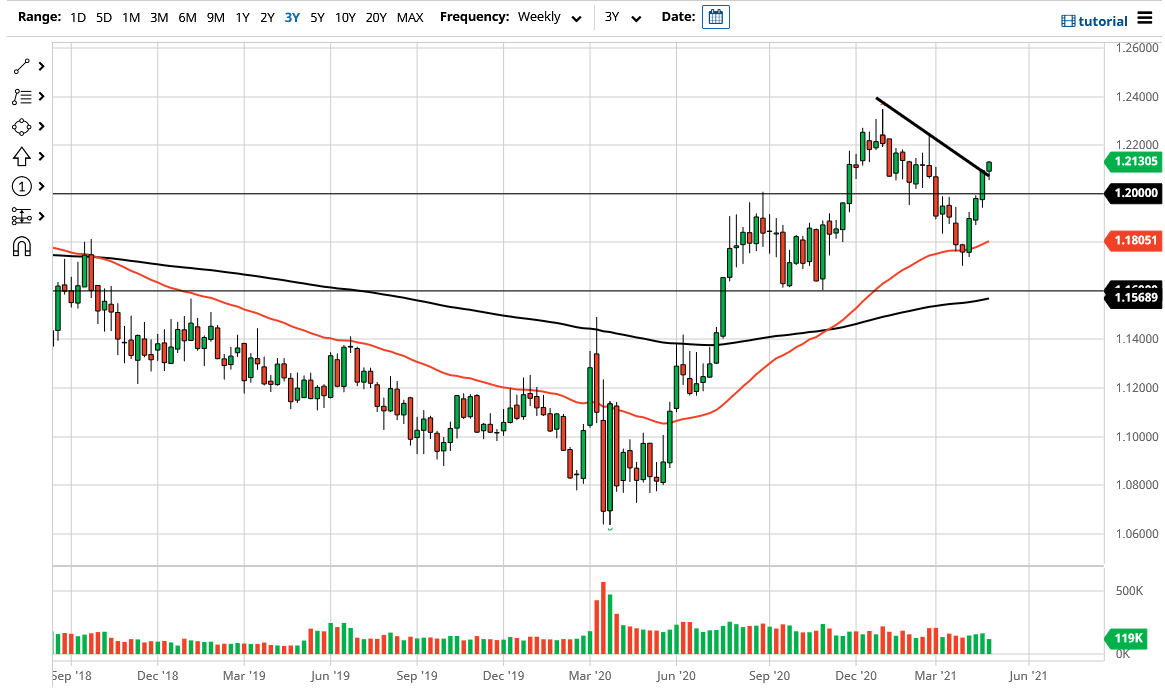

I do believe that the initial target would be the 1.22 handle, and then after that we probably would go looking towards the 1.23 level. Because of this, I think that short-term pullbacks will be buying opportunities, as this is rapidly becoming a “buy on the dips” type of situation. I think that the 1.20 handle underneath should be supported, assuming that we do break back down below the trendline that I have marked on the chart.

The one thing that might be worth paying attention to is the fact that we are a little bit overextended heading into the month, but it is obvious that the entire attitude of the market has changed, and the US dollar is starting to show signs of weakness not only here but in multiple pairs around the world. Because of this, I believe that the month should be relatively straightforward, but keep in mind that the euro does like to be very choppy, as it is the realm of high-frequency traders these days. Ultimately, this should be a positive month.