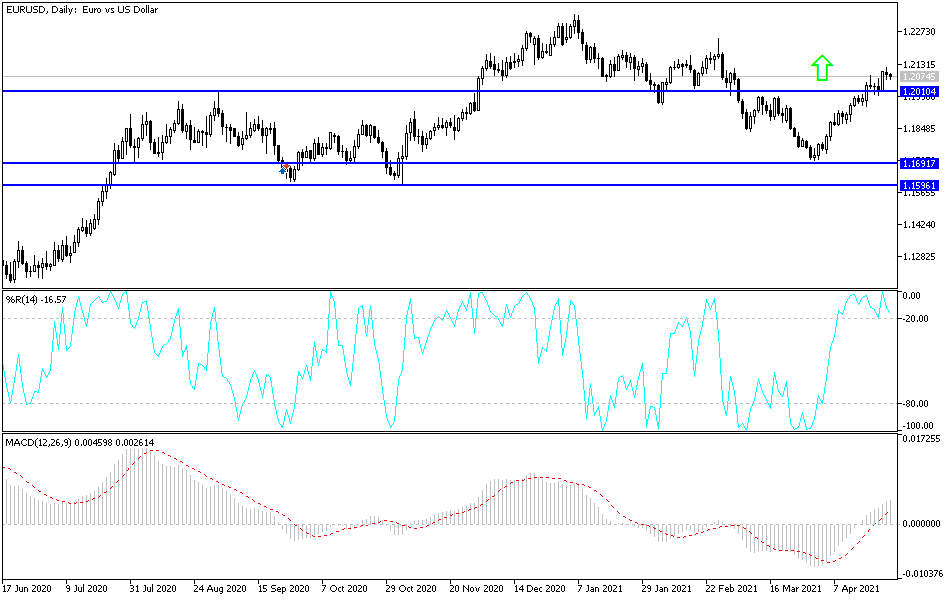

The euro has gone back and forth during the trading session on Monday, showing signs of hesitation right around the 1.21 level. Furthermore, there is also a downtrend line in that general vicinity that is affecting the markets as well, so it is worth paying close attention to this general vicinity.

When you look at the chart, you can see that the 1.21 level has offered a significant amount of selling pressure previously, so one has to wonder whether or not the market can continue to go higher. While everybody is looking at the US dollar and trying to figure out a way to short it, at the very least we are probably oversold. Underneath, the 1.20 level should be a significant amount of support, as it had been previous resistance. The 50-day EMA is racing towards that area, so it must certainly be paid close attention to as it will be a technically important area.

If we were to break down below the 50-day EMA, it could send this market lower, perhaps driving it towards the 200-day EMA given enough time. The 200-day EMA attracts a lot of attention as well, so we would have to repeat the process in that general vicinity. This would be a recovery of the dollar, that most people were not paying attention to. That could have a flood of money jumping into the market as people try to catch up.

On the other hand, we could break above the downtrend line, and that should open up a move towards the 1.22 handle. That is where we have seen a significant amount of resistance previously, so I think that if we do break out from here, it is likely to see trouble rather quickly. The market breaking above the 1.22 level then opens up a move towards the 1.23 level which was also resistance. This would be typical behavior for the euro, as it does tend to like chopping around back and forth overall, and therefore you should not be looking for major moves, at least not very quickly. The euro is getting a little bit of a boost due to the idea that the European Union may be doing a little better than once thought, but we have the Federal Reserve meeting over the next couple of days that could cause some noise.