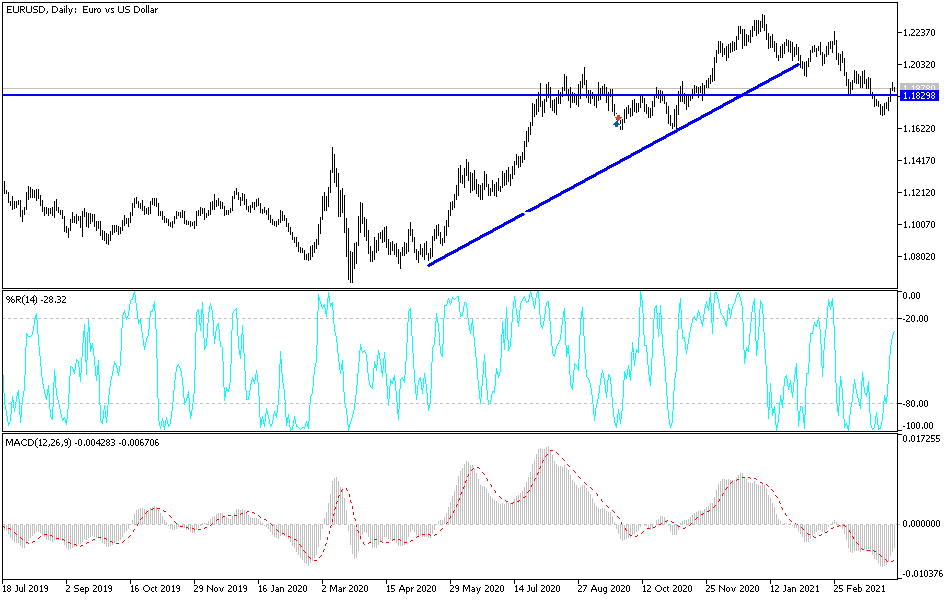

The euro rallied significantly during the trading session on Wednesday but gave up gains above the 1.19 handle. By doing so, the market is getting a little bit stretched, but at this point in time I think it is a question of whether or not yields in America are starting to fall or rise again. At this point, it certainly looks as if yields may be trying to rally again, and if that is going to be the case it should continue to favor the US dollar. If we break down below the bottom of the candlestick for the trading session on Wednesday, that would be the technical signal to start selling.

Furthermore, the previous uptrend line is just above and so is the 50-day EMA. That is an indicator that some people will pay attention to, so one would have to think that there would be a certain amount of selling. What I am more interested in is that we had broken through a trendline and now we have come back to retest it. So far, it looks like we are failing to break through it. If that is going to be the case, then I think we are going to make that move towards the 1.16 level underneath that I had been calling for previously.

This is not to say that I do not recognize that we have had a significant bounce, but this has all been about the bond markets. The bond markets probably got way ahead of themselves, but now it looks like they are trying to reassert the trend that they had been in. If you want to see a nice correlation, put a chart of the 10-year yield up against the EUR/USD pair, and you can see just how highly correlated they are. It is even more correlated to the USD/JPY pair.

As German bunds are offering negative yields, it does not take too much in the way of imagination to understand why the euro may start to drift lower. Obviously, the 200-day EMA will have its say, but looking at this juncture I think it is probably going to be very noisy, but I do favor the downside still, at least until we get a daily close well above the 50-day EMA.