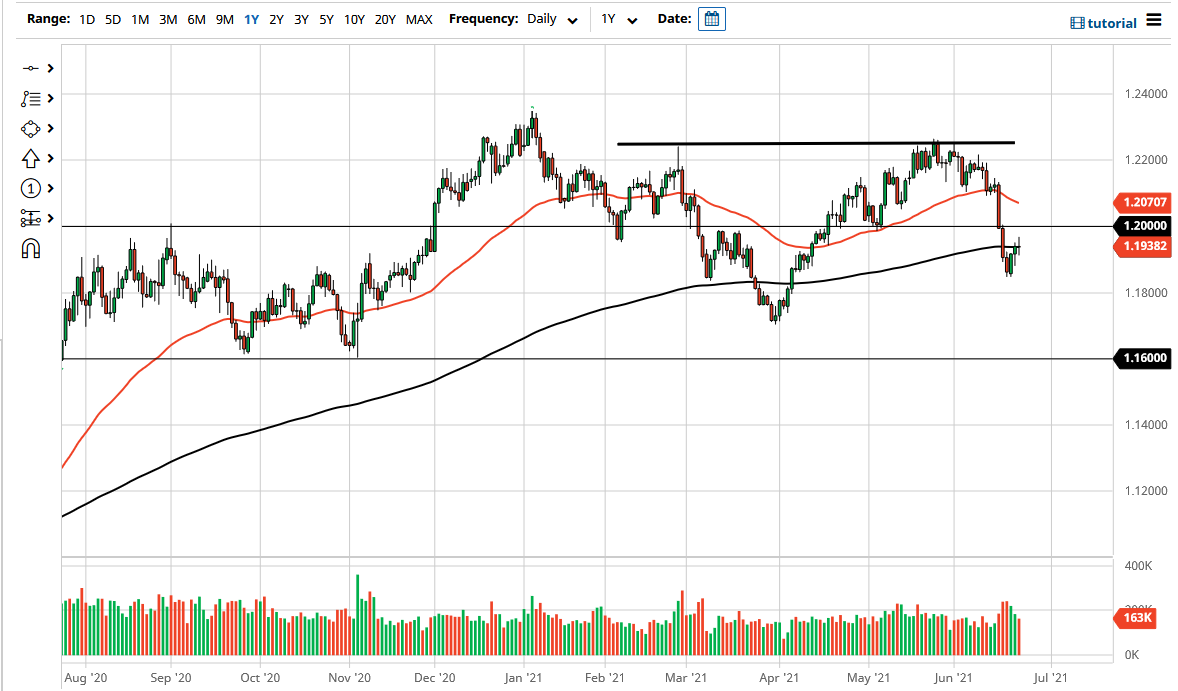

The euro rallied significantly at the end of the trading day in the United States, as we continue to see the US dollar get hammered by US traders. It is worth noting that the market has broken above the top of the shooting star from Tuesday, which suggests that the market is likely to go looking towards the 1.21 handle. The 1.21 level has been resistance, but I think there is even more resistance at the 1.22 handle. In fact, the 1.22 handle is likely to see a lot of selling pressure as well. The US dollar is on its back foot, but this seems to be on the euro more than anything else.

The euro may be flexing its muscles due to the idea that perhaps the economy in the European Union is starting to perk up a bit. With that being the case, the market is likely to see a lot of volatility, and it will be interesting to see whether or not there is significant follow-through once we open up on Monday. I do think that there is more likelihood of the market trying to rally in the short term, mainly because of the momentum involved. However, you can only read so much into the push late on Friday due to the fact that it was more of a slow drip higher, with only Wall Street trading.

As far as selling is concerned, I have no interest in doing so, at least not right now, as the 1.20 level underneath needs to be cleared in order to make that happen. I think that we will continue to look at this as an indictment on the US dollar as well, so pay close attention to the US Dollar Index. Ultimately, that will determine where we go next. It is interesting, though, because the move might be more or less based upon the euro, due to the fact that the gold market is showing weakness while the euro is rallying. This is very interesting to say the least, so this might be a bit of an anomaly more than anything else. The British pound obviously did not fare as well, so this tells me that this is more about the euro currently than anything else. Nonetheless, I hear a ton of noise just above that is going to continue to be an issue.