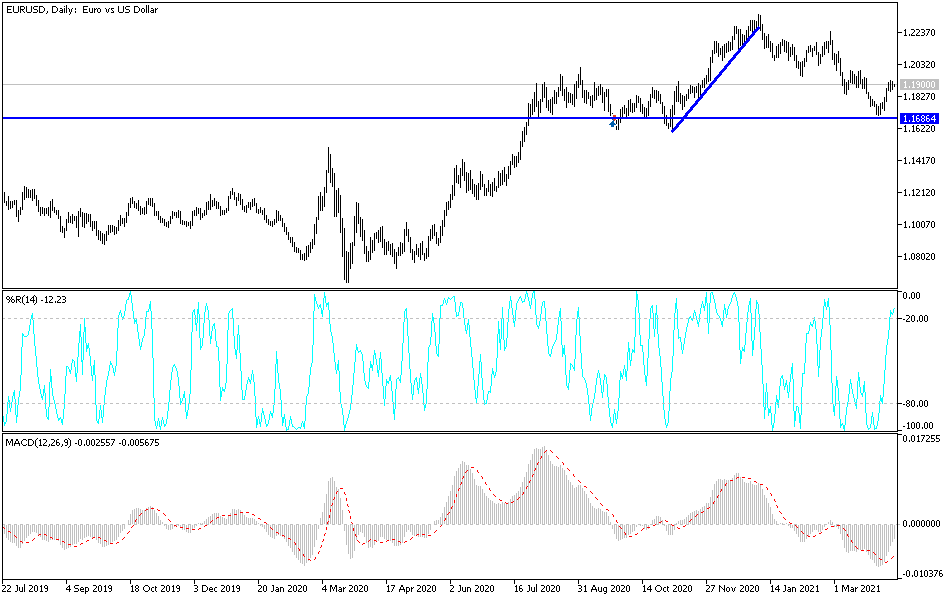

The euro initially fell during the trading session on Friday, but then turned around to form a bit of a hammer. This suggests that the market is going to continue to try to break above the 50-day EMA just above, so it should offer a significant amount of resistance. However, if we were to break above there, then we could take out that previous uptrend line, allowing the market to go looking towards the 1.20 handle above.

If we can break above the 1.20 handle above, then it is very likely that we will see this market continue to go higher. That would be one of the most bullish things that we could see right now, so it should be paid close attention to. The only reason that I think this could happen is the fact that we had formed a hammer during the previous week, and then a somewhat bullish candlestick that shows up on the weekly time frame now as well.

When you look at this chart, you can see that we are stuck between the 50-day EMA and the 200-day EMA, which typically means that we will see a lot of choppy behavior in this general vicinity. In fact, if you look at the last three candlesticks, we have seen a shooting star, followed by a very bullish candlestick, followed by an attempt to break down even lower, only to turn around and form a hammer again. With that being the case, the market is likely to be very difficult to hang onto the rail, but it is clear that we are at an inflection point that we need to resolve. As soon as we can get through this time frame, the market is more than likely going to make a rather significant decision.

While I do not think this is a market that is going to be easy to trade in the short term, the reality is that we should see some type of impulsive candlestick that allows us to follow it. I am going to be very patient and would probably look at this as some type of secondary indicator that I can use to trade the euro against other currencies. Eventually, we will have to resolve the tension, but it is worth noting that the previous weekly candlestick was in fact a hammer.