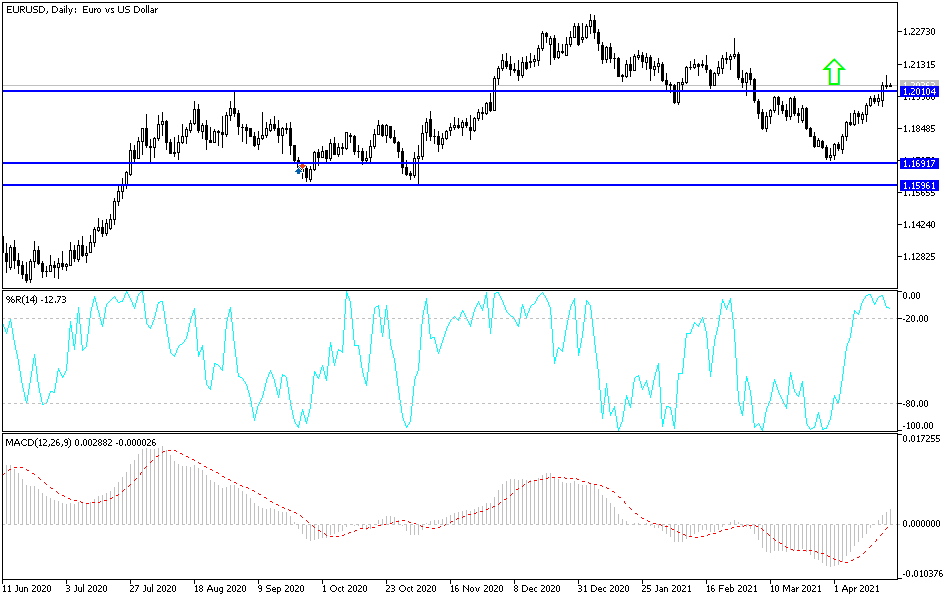

The euro initially tried to rally during the trading session on Tuesday but gave up all of the gains to form a massive shooting star. That being said, there is plenty of support underneath, and I think that the 1.20 area is an area that we need to pay close attention to. I believe that between there and the 50-day EMA, there should be plenty of support, as we have recently seen such a major breakdown. That breakout should have a bit of “market memory” attached to it, so I think it makes sense that there are traders willing to get involved on some type of pullback.

If we were to break down below the 50-day EMA, then we will probably go looking towards the 1.1850 level, which was an area of support previously. If we were to break down below there, then the market is likely to go looking towards the 200-day EMA, which is closer to the 1.1839 handle. Obviously, if we break down below the 200-day EMA, then the market is likely to go even lower, perhaps reaching down towards the 1.16 level eventually. The 1.16 level is crucial, so it is most certainly worth paying close attention to, as it was a major support level previously.

To the upside, if we can take out the top of the shooting star, then it is likely that the market will go looking towards the 1.22 handle, which is an area where we have seen a lot of resistance previously. If we were to clear that, then the market is more than likely to go looking towards the 1.23 handle after that.

In general, I think the one thing that you are probably going to see is short-term choppiness, but if this is a simple “breakout and retest”, then we should see buyers re-enter this market in the next day or two. I am not a huge fan of trading this pair, because it barely moves half the time, but it is a good indicator as to what the US dollar is doing. That being said, even though we have formed a very negative candlestick for the trading session on Tuesday, it does not necessarily have me changing my opinion as to where we are getting ready to go.