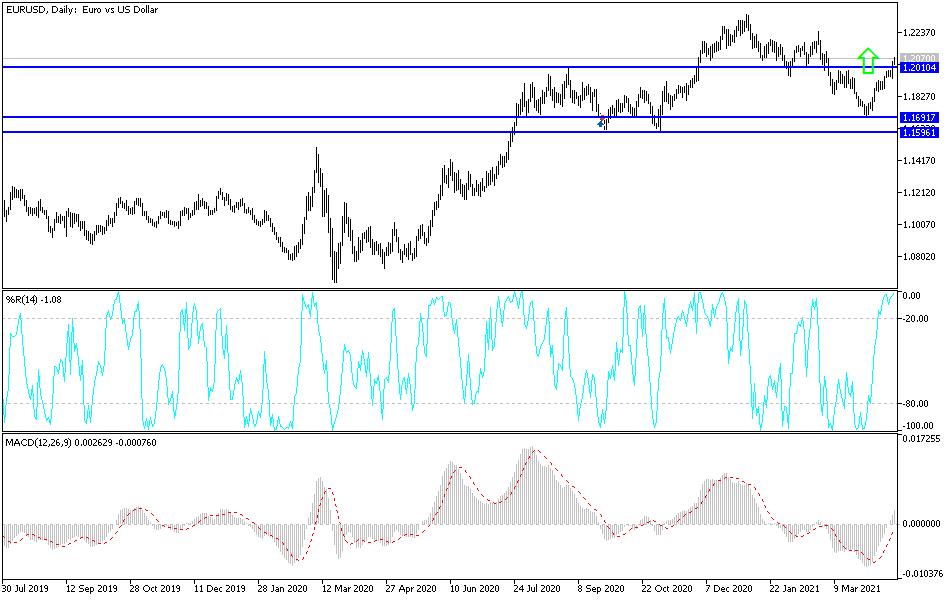

The euro has broken above the crucial 1.20 level, an area that has been significant resistance more than once. Now that we are broken above there, it is likely that the market is ready to continue to go higher. The market seems to have quite a bit of support underneath, and now that we have broken out above that level, it makes sense that we would see plenty of interest in dips. The 1.20 level will probably offer a lot of support as “market memory” comes into play, and we have the 50-day EMA underneath there offering support.

To the upside, the 1.21 level would be the initial target, followed by the 1.22 level. We have been in an uptrend for some time, but the last couple months have not been kind to the euro. Clearly, however, we are starting to see the US dollar struggle again. As long as the US dollar continues to struggle, then the euro by its very nature would get a bit of a boost due to the fact that it is known as the “anti-dollar” currency.

It is worth noting that we pulled back initially on Monday to reach towards the 50-day EMA, only to turn around and rally significantly. The downside features not only the 50-day EMA as potential support, but also the 200-day EMA. The 200-day EMA sits near the 1.1830 level, so I think that would be thought of as the “floor in the market” going forward. The breaking above of the 1.20 handle is something that is obviously strong, so it is likely that we will see more money come flying into this market.

You can also look around the Forex world and see that the US dollar has been hit against almost all currencies, so in and of itself we are getting plenty of reasons to get long of this market. The British pound, Australian dollar, and Japanese yen have all been very strong performers against the greenback, and it now appears that the fate of the US dollar is starting to be known, and we should start to get nice trending action in multiple pairs, not just this one. The corrective phase of the euro seems to be coming to an end.