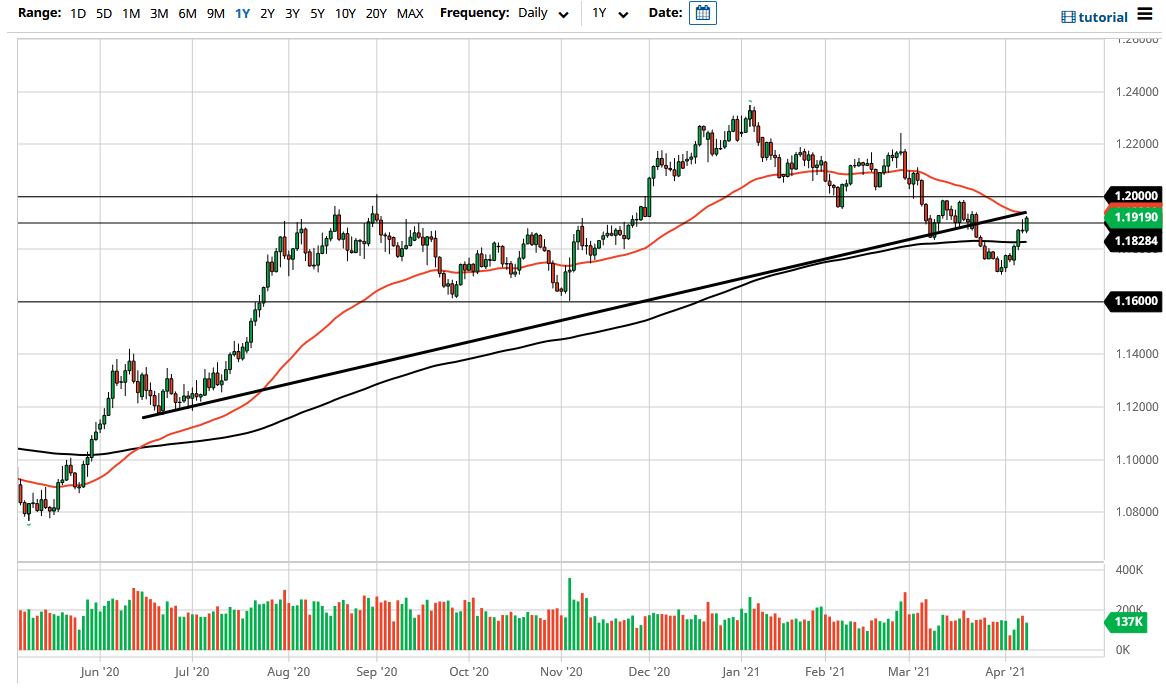

The Euro has turned around a break slightly above the shooting star from the previous session on Wednesday, as it continues to see massive inflows. That being said, we are currently testing the 50 day EMA and the previous uptrend line from the bottom. This typically means that there might be some noise, and we have also gotten close to a major sell off point. The question now is whether or not we are recovering, or are we simply getting towards the end of the pullback?

The candlestick is somewhat impressive, but with the 50 day EMA sitting just above and that trendline showing up in the same place, the question now is whether or not the market is okay with being above the 1.19 handle. The market has seen a lot of congestion in this area, and therefore I think it is only natural that we would see a bit of hesitation. Whether or not we can continue to get above there might be a completely different question, probably based more or less on the idea of what yields are going in the United States. After all, both the ECB and the Federal Reserve are buying bonds as quickly as they can, so it is essentially a race to devalue currency.

If we do break above the 50 day EMA, and perhaps even more importantly the 1.20 handle, then the market is likely to go looking towards the 1.22 handle. The 1.22 handle of course is a major barrier for people to deal with, as we had sold off quite drastically in that area. In other words, no matter what happens next, I think the one thing that you can count on is a lot of noise in the market, but that is nothing new for this pair. Because of this, I think that we could very well see some type of reason for this market to break down, and as soon as we do break down, I think it is likely that we would go looking towards the 1.16 level underneath which has been a massive support level. It has not been tested yet this time around, so one would have to think that there are some people out there trying to get there. This does not mean that we get there quickly, because this pair almost never moves quickly.