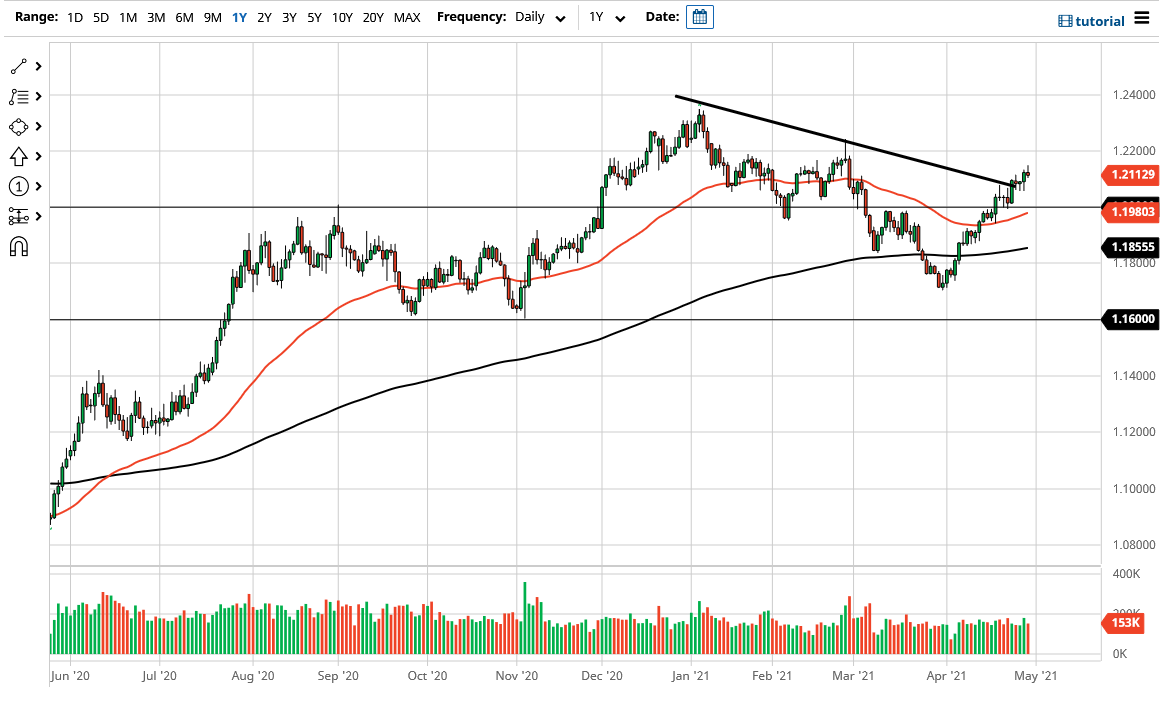

The Euro initially tried to rally during the trading session on Thursday but gave back the gains to form a bit of a shooting star. Nonetheless, this is a market that I think is very strong, so I am not overly concerned about the size of the candlestick, rather I am looking at the overall length of the trend, and I recognize that the market probably needs to pull back just a bit.

That pullback is not necessarily something to be overly concerned about, rather a sign that we are going to find buyers underneath to try to continue to push this market higher. You can see that we have broken above a downtrend line, which of course is a good sign, but also quite typically gets retested. Furthermore, the 1.20 level underneath should be supported, right along with the 50 day EMA.

As long as the Federal Reserve is flooding the market with liquidity, and of course Joe Biden is hell-bent on spending roughly $10 trillion this year, it is probably going to put significant pressure on the US dollar in general. The Euro is also getting a bit of a boost due to the economic picture in the European Union looking slightly better, and we are even seeing bond yields rally and in that part of the world. If that is going to be the case, then the interest rate differential should start to favor the euro a bit, or at least not be “quite as bad” as it had been previously.

If we do break above the top of the shooting star, then it opens up a move to the 1.22 handle, which of course is the massive selloff had been previously where the shooting star touches the downtrend line. With this, I think it is only a matter of time before we reach there but I also recognize that it would probably be a lot of resistance just waiting to happen. If we can clear that level, then it is likely that we could go to the 1.23 handle. However, if we were to break down below the 50 day EMA, we may have to pull back a little deeper to reach towards the 200 day EMA, which is currently at the 1.1855 handle. With all of that being said, the market is likely to see a bit of a pullback, but I do believe that eventually the buyers will return.