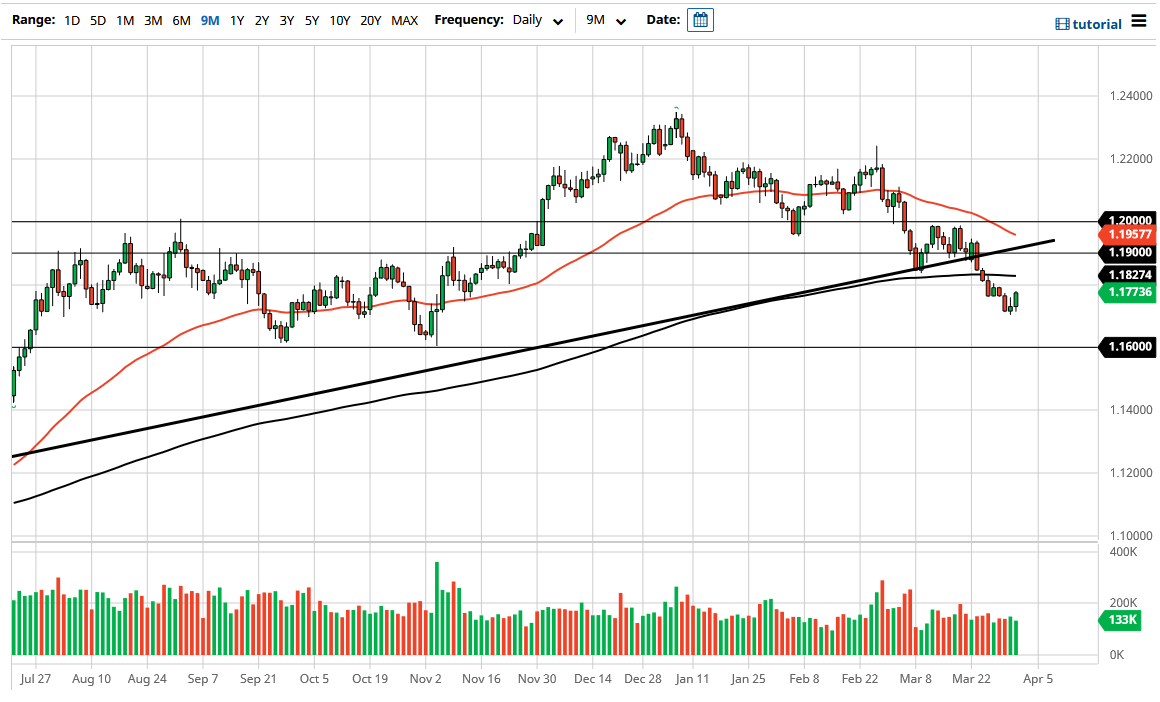

The Euro bounced significantly during the trading session on Thursday as the 1.17 level has offered significant support. That being said, I think that it is only a matter of time before the sellers return, because the situation in the European Union is not conducive to strength at the moment.

The 200 day EMA sits at the 1.1820 level and drifting lower. With that being the case, I think we will continue to see resistance above, and therefore I like the idea of shorting this pair on signs of exhaustion, but right now it is a bit much to ask for the markets to do a lot during Good Friday. Because of this, I would not be surprised at all to see the market do very little. However, one thing that is worth paying attention to is that we have been in a downtrend for a while and the most significant amount of support underneath is near the 1.16 level, and markets have a habit of reaching towards those major levels.

I think that the 1.16 level will probably be rather supportive and could even extend down to the 1.15 handle. If we break through there, then the Euro is almost certainly going to go looking towards the 1.12 level underneath, which is the next major support level. All of that being said, this will be the most likely of move that we continue to see yields spike in the United States. However, if the market were to see yields dropped rather drastically, then we could see the Euro break above the 200 day EMA, reaching towards the 1.19 level after that. The previous uptrend line intersects in that general vicinity, so I would anticipate that would be significant resistance.

All things being equal, I think that the Euro is going to continue to underperform most currencies, and that will be especially true with the US dollar. Ultimately, I think that the Euro is probably going to be one of the underperformers for Q2, especially as those coronavirus vaccine seem to be sluggish to say the least. Even though we had good economic numbers coming out of Germany for the session, the longer-term reality is much murkier in the EU than it is in the US, and I think that will play out in this chart for a little while longer.