The German index has rallied significantly during the trading session again on Thursday as we continue to see the DAX outperform a lot of indices globally. After all, the German index has been a reflection of the potential turnaround in the European Union although there has been major issues when it comes to distributing the vaccine. This of course has led to more lockdowns, and although France is locking itself down, it appears that Germany is starting to at least the regional opening.

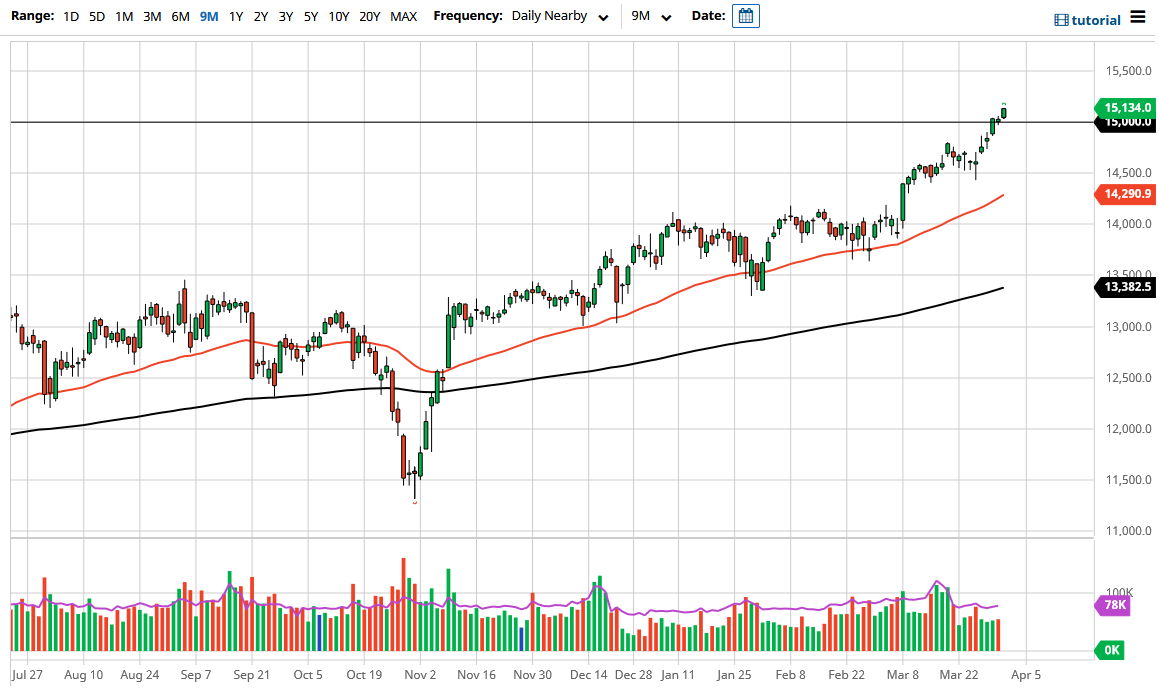

The candlestick closing at the top of the range of course suggests that there will be a bit of follow-through in the market. Furthermore, it is worth noting that we are above a major resistance barrier in the form of 15,000, and now that we are beyond that the market will probably start the “next leg higher.” I look at pullbacks on short-term charts as potential buying opportunities and it is very likely that the 15,000 level will offer a bit of short-term support. Even if it did not, there is a gap near the 14,700 level that could also come into play as well.

At this point, I suspect that the initial target is going to be 15,250 above, and then possibly the 15,500 level. The market is in an uptrend, so regardless of what happens I am going to be a buyer on dips. The 50 day EMA is at the 14,290 level, and I think that is an area that will be massive support, assuming that we even get down to that area. All things been equal, this is a market that I think continues to find buyers going forward, especially as the Euro is losing strength in general. That makes German exports more competitive globally, as the market will be focusing on the fact that those German industrial components become cheaper as the rest of the world tries to rebuild their economies.

All things been equal, there is no scenario in which a willing to short the DAX in the next several weeks, as I believe we will continue to focus on that reopening trade globally. The DAX will be one of the major beneficiaries, right along with the US indices and other major economies. The market may have the occasional pullback, but I will be looking at that as an opportunity to get long of a market that I think has much further to go.