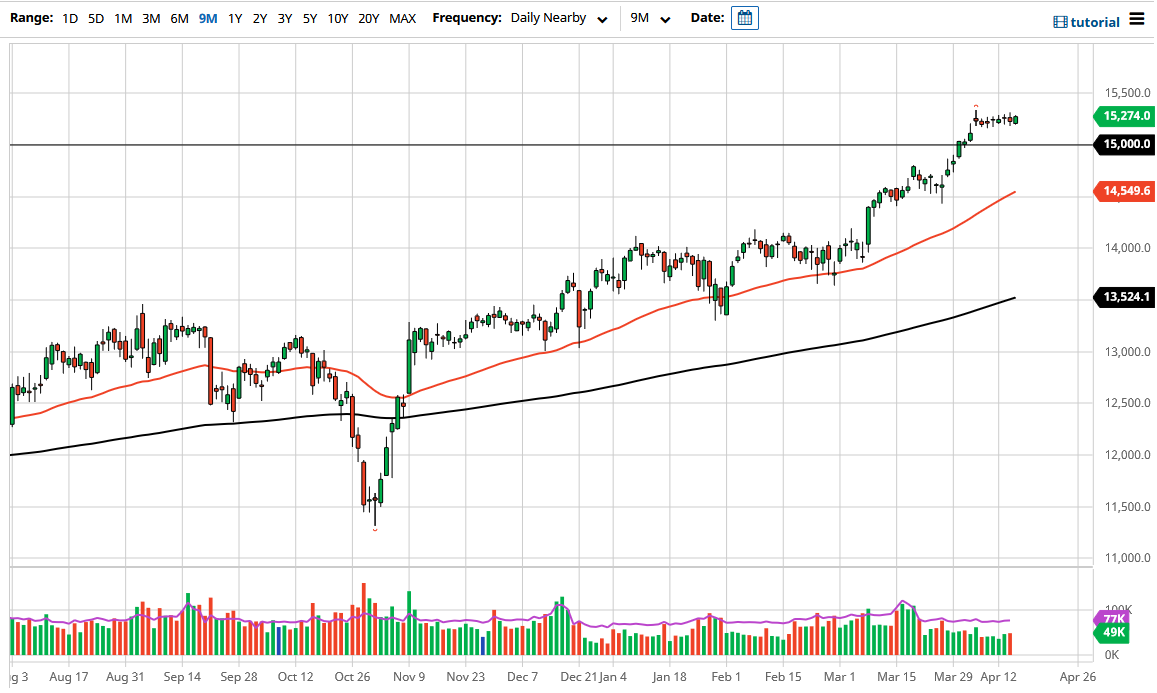

The German index rallied a bit during the course of the session for Thursday, as we are threatening the 15,300 level. At this point, if the market is to break above there, the market is likely to go looking towards the 15,500 level. The 15,500 level of course is a psychologically important, but at the end of the day this is a market that has been very bullish for some time, and it is likely that we will continue to see buyers jumping in every time they get an opportunity to pick up a little bit of value on the pullback.

Underneath, the market is likely to see plenty of support underneath near the 15,000 level, and of course the gap that sits just above it. All things being equal, these pullbacks will be looked at as an opportunity to get involved in a longer-term trend, and therefore it is almost impossible to short the DAX. After all, the DAX is considered to be the “blue-chip index” of the EU, and therefore we should continue to see a lot of money flowing into that index going forward. The German economy is based on exports, so the idea of the reopening trade coming into vogue would be good for the DAX. After all, there are huge exporters involved in the top of the index, and that should continue to be a major issue.

If we were to break down below the 15,000 level, we could break down towards the 14,550 level, which is where the 50 day EMA is. The 50 day EMA is obviously a very strong technical indicator that a lot of people pay attention to, so all things being equal I think that the market cannot be shorted, so it simply a matter of trying to find some type of supportive action underneath, or perhaps some type of break out above the top of the range for the trading session on Thursday. Either way, we should have a nice opportunity to get long given enough time. Nonetheless, the market is likely to see the occasional hiccup that you can take advantage of. Look at the size of the candlestick and how it is engulfing several previous one, and this tells you that we are more likely than not to see a continuation in the short term rather than a pullback.