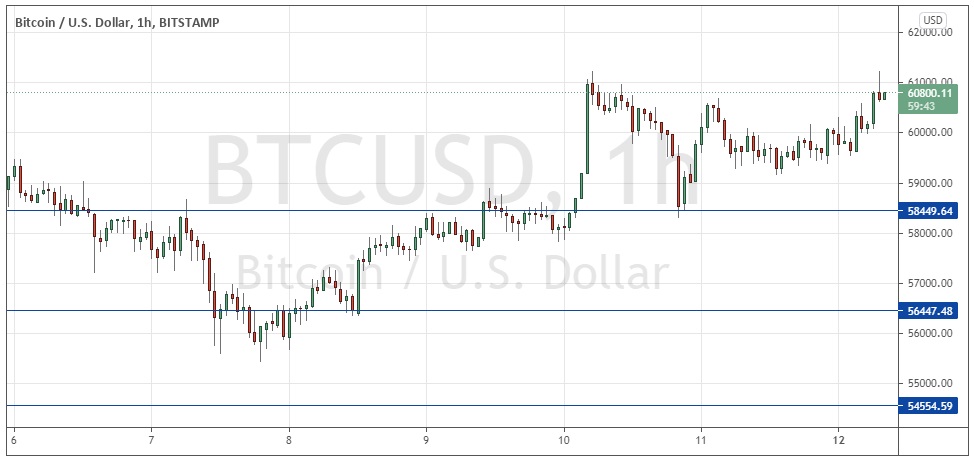

Last Wednesday’s Bitcoin signals produced a nicely profitable long trade entry from the strong bullish bounce at the support level at $56,447 which occurred that day.

Today’s BTC/USD Signals

Risk 0.50% per trade.

Trades must be taken prior to 5pm Tokyo time Tuesday.

Long Trade Ideas

Go long after a bullish price action reversal on the H1 time frame following the next touch of $58,450 or $56,447.

Place the stop loss $100 below the local swing low.

Move the stop loss to break even once the trade is $100 in profit by price.

Take off 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

I wrote last Wednesday that we had very choppy, consolidative trading below $60k which suggested topping before a bearish breakdown. I saw the support level at $56,447 as a classic neckline.

I was therefore looking to take either a long trade from a bullish bounce there, or a short trade if we get two consecutive hourly closes below that level. I thought that a breakdown was more likely.

I was correct to see this level as pivotal and it gave a very nice long trade entry from a bouncing, bullish engulfing candlestick on the hourly chart which gave good profit.

The technical picture is now much more bullish as the price trades above the big round number at $60k and just below its record high between $61 and $62k. It is true we are seeing at the time of writing a bearish hourly candlestick which looks as if it is rejecting $61k which would make a bearish double top. Therefore, an hourly close above $61k could be a good signal to enter a long trade which could blow through to an all-time high, and then the price would be free to potentially rise much further through blue sky. I will take a bullish bias here if that sets up and I will not look for any short trades today.

Concerning the USD, there will be a release of the FOMC Meeting Minutes at 7pm London time.