Last Monday’s Bitcoin signals were not triggered, as none of the key support levels identified were reached.

Today’s BTC/USD Signals

Risk 0.50% per trade.

Trades may only be entered before 5pm Tokyo time Thursday.

Long Trade Idea

Long entry after a bullish price action reversal on the H1 time frame following the next touch of $61,240.

Put the stop loss $100 below the local swing low.

Adjust the stop loss to break even once the trade is $100 in profit by price.

Remove 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

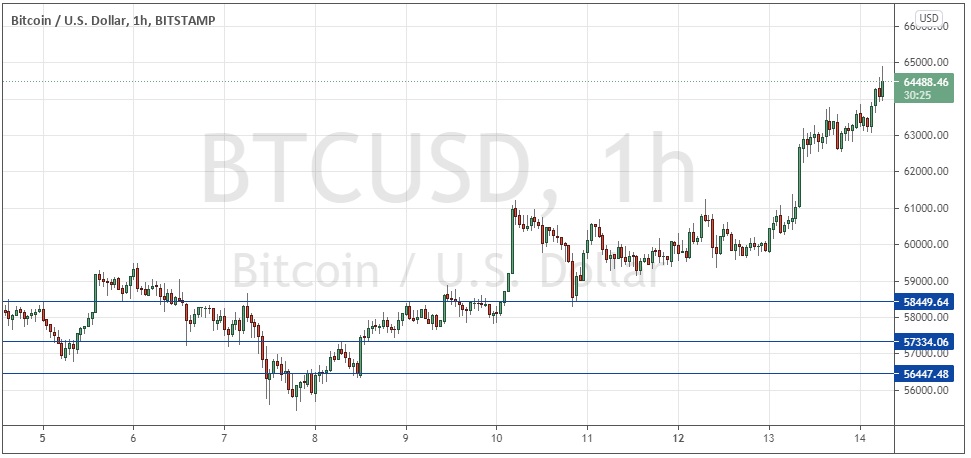

I wrote last Monday that the technical picture had become much more bullish as the price traded above the big round number at $60k. I saw minor resistance at $61k so I thought that an hourly close above $61k could be a good signal to enter a long trade which could blow through to an all-time high. This was a good call as after continuing to reject $61k for some hours, the price finally broke out above $61k on the hourly chart and produced an excellent and very profitable long trade from the breakout.

The price has continued to rise solidly and has touched as high as just below $65k, making new record-high prices. We have strong bullish momentum and every reason to believe the price can go higher as it is trading in blue sky and the subject of intense speculative interest. Of course, the price could fall quite heavily from new highs at any time, as often happens in bullish breakouts, but the odds are clearly with the bulls.

Swing traders are probably best advised to wait for a pullback, ideally to the former minor resistance at $61k, to look for a bullish bounce to give an entry. Shorter-term traders should just wait for decent pullbacks which exhibit firm bullish reversals on shorter-term time frames for long trade entries.

I take a bullish bias on Bitcoin and would not take any short trades today.

Concerning the USD, the Chair of the Federal Reserve will be giving a minor speech at 5pm London time.