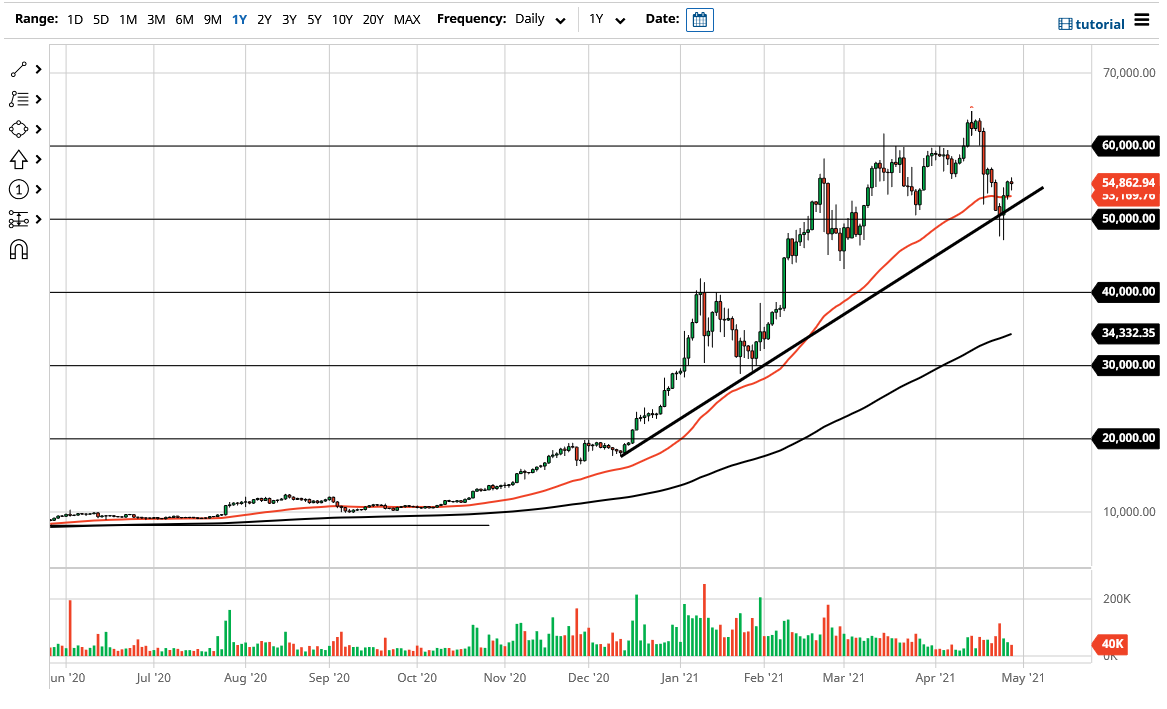

Bitcoin markets went back and forth during the trading session on Wednesday as we saw plenty of volatility awaiting the Federal Reserve decision. Nonetheless, Bitcoin certainly looks as if it is ready to go to the upside, and the recent bounce from the $50,000 level is something that should be paid close attention to. After all, it is a large, round, psychologically significant figure that would attract a lot of attention.

Furthermore, that area also featured the 50-day EMA sitting just above it, and the uptrend line that you can see on the chart. We have previously seen it offer support, and the fact that we ended up forming a hammer followed by an even bigger hammer suggests to me that we are in fact going to eventually try to rally. We have already done this, and now that we are clearly above the 50-day EMA, I believe that at this point it is likely that we will see a “buy on the dips” type of mentality going forward. After all, the market does suggest that we are going to see quite a bit of volatility and choppiness, but there is nothing particularly ominous about the area just above that makes me think the market cannot get above there.

In the short term, the $55,000 level looks to be offering significant resistance, but that is short-term only. Eventually, we will break above there and go looking towards $60,000. The US dollar will probably continue to be beaten up a bit as the Federal Reserve is going to stay very dovish going forward, and it is very likely that the market will just continue doing what it has been doing. In fact, I do not necessarily see a concern in this chart, unless we were to break down below the $40,000 level. Obviously, breaking down below the $50,000 level would be a bit of a letdown, but at the end of the day it now looks as if it is going to offer a bit of a “floor in the market” going forward. As long as that is the case, I do believe that we will eventually see this market break above the $65,000 level and continue going higher, especially now that institutional money is involved.