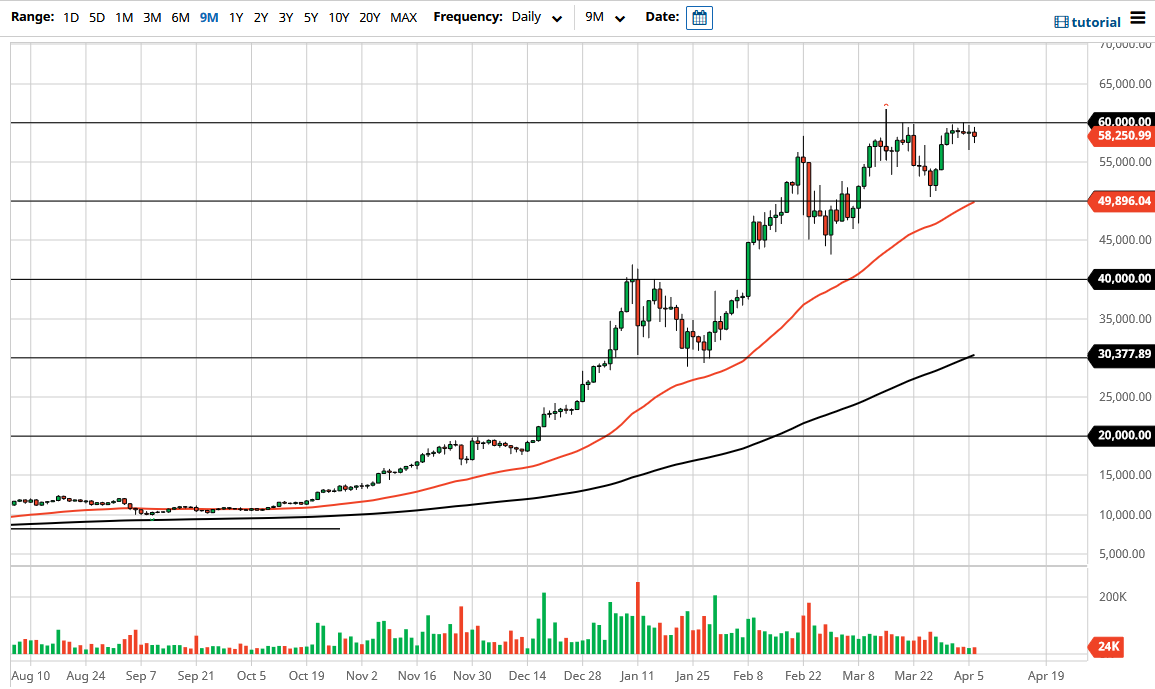

The Bitcoin market was very quiet again during the trading session on Tuesday as we continue the overall consolidation. The market has certainly seen the $60,000 level as a potential barrier, and the last couple of days have been lackluster to say the least. This is not to say that we should be selling this market, rather that the market looks at $60,000 as a bit difficult to get above. Nonetheless, I do think it is only a matter of time before it happens.

With that in mind, I have absolutely no scenario in which I am looking to short Bitcoin, even though we may get a bit of a pullback in the process. If we do get that pullback, there are multiple areas where I would anticipate seeing support, starting with the $55,000 level. If we were to break down below there, then I think the market will go looking towards the $50,000 level, which is also backed up currently by the 50-day EMA. The 50-day EMA is a huge technical indicator that a lot of people will follow, so it makes sense that it continues offer dynamic support. Even if we break down below there, I think there is plenty of support near the $45,000 level underneath.

To the upside, if we can get a daily close above the $60,000 level, then it is likely that we are ready to continue to go higher, perhaps reaching towards the $62,500 level. After that, the market will then go looking towards $65,000. That being said, I do believe that the market is likely to continue seeing a lot of upward pressure given enough time, and eventually we will go much higher as institutional money starts flowing into the Bitcoin market.

The overall attitude of the market remain strong, but we have a little bit of work to do to work off some of the excess froth, as the market had gained so rapidly several months ago. We have not had a strong consolidation worthy of the rally that we have seen yet, and that might be what is currently working against the value of the market. Furthermore, it is worth noting that some other altcoins have attracted quite a bit of attention as well, perhaps taking some money out of the Bitcoin market in the short term.