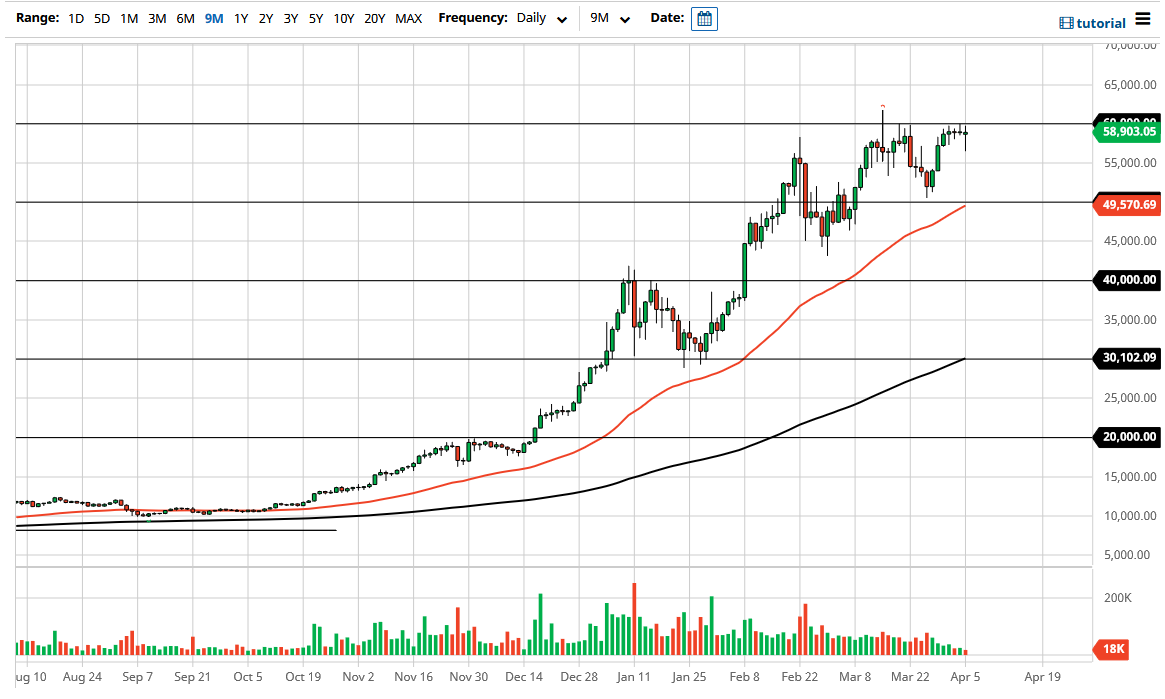

Bitcoin markets have gone back and forth during the trading session on Monday as traders came back to work. The shape of the candlestick is a hammer, but this shows just how much trouble we are having to get this market above the $60,000 level. That seems to be a bit of a “ceiling in the market” currently, and as a result it should not be a huge surprise that we have pulled back multiple times again. In fact, every time we have approached $60,000, there has been selling pressure as seen by the shooting star from a couple of weeks ago.

The range was rather large, especially in comparison to the last three sessions. We had been grinding sideways over the last couple of days, without the ability to jump over this major area. That says that we are possibly in a bit of an accumulation phase, and I do think that seems to be the case when I look at crypto currency in all markets. It is not just Bitcoin, it is all currencies such as ADA, VeChain, and Ethereum. With that being the case, I do believe that we are simply taking a bit of a breather until we can continue higher.

The market has been very noisy, but only for the short-term traders. For those of you who have been hanging onto the longer-term trade, you can see clearly that it has been a “buy the dip” type of scenario, and I just do not see that happening to change anytime soon. I also believe that the 50 day EMA comes into the picture, right underneath the $50,000 level. That me is a short-term floor in the market, and I think that there would be a lot of people getting involved in this market in that general vicinity. If we break down below there, the market then finds support again at the $45,000 level. Underneath there, things might get a little bit dicey, but nonetheless this is a market that seems to be very likely to continue going higher given enough time. I do not believe that selling is possible at this point in time, as the trend has been far too strong and of course institutional money continues to flow into the marketplace and would be a bit of a natural buffer for any selling.