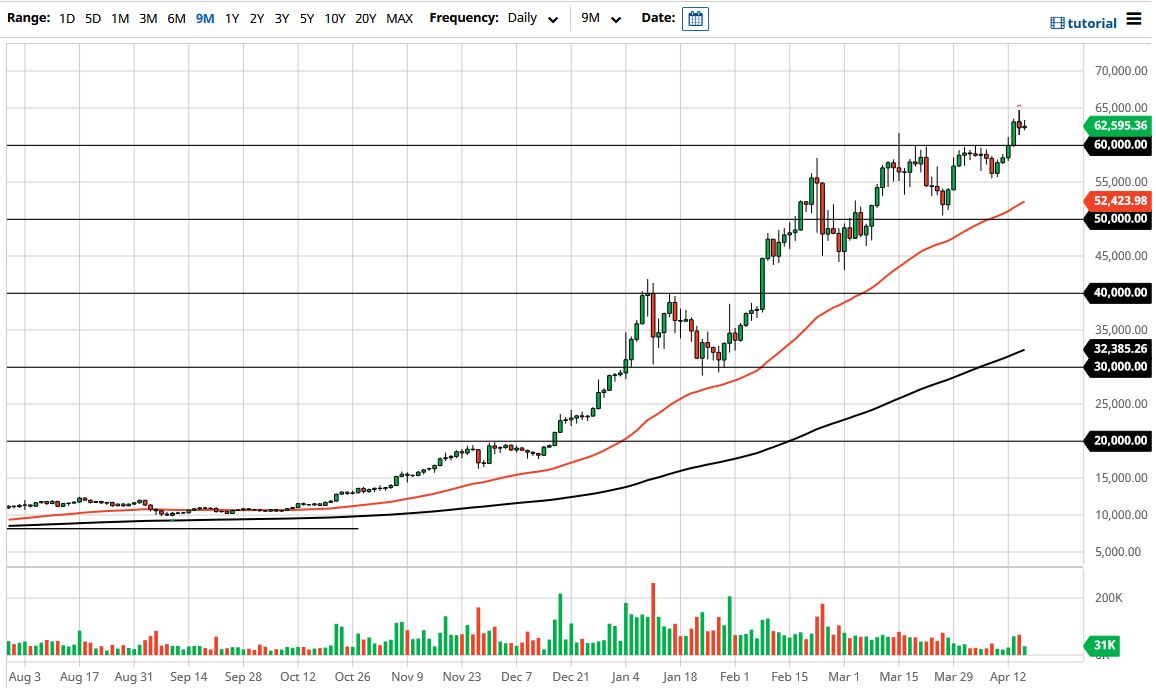

The Bitcoin market initially tried to rally during the course of the trading session on Thursday but gave back the gains to form a shooting star of sorts, just as it did during the previous trading session. The $65,000 level above seems to be massive resistance, and therefore it is likely that we will continue to see quite a bit of noise just above. If we were to break down from here, which of course the dual shooting star candlestick formation suggests, then I believe that the $60,000 level should be psychological if not structural support going forward.

The $60,000 level had previously been resistance multiple times, and therefore it should be supported going lower. Even if we were to break down below that level then I think the $55,000 level will be significant support, as well as the 50 day EMA reaching towards the $52,500 level. After that, then you have the $50,000 level offering support as well.

If you look at that market, you can see that we have been very choppy on the way up, but the pullbacks continue to be relatively shallow. That being the case, the market is likely to continue finding buyers on these dips, due to the fact that the Bitcoin market has been so explosive to the upside during the last several months. Yes, we are a bit stretched at the moment, but it is only a short-term overbought condition, and clearly with all of the institutional money coming into Bitcoin, it makes sense that we will continue to see it rise.

The shape of the candlestick of the last couple of days should give us an idea that we have a pullback coming, but it does not necessarily mean that it needs to be some type of massive break down. I think this simply means that the market is probably going to continue to find buyers going forward, and if Bitcoin does pull back significantly, then more likely than not we will see large amounts of institutional money coming into the market and pick up “cheap coins.” I have no interest in shorting this market, simply due to the fact that we have such a bullish run going forward, and therefore it is hard to imagine a scenario in which we break down. In fact, I would not be concerned about Bitcoin until we break down below $40,000.