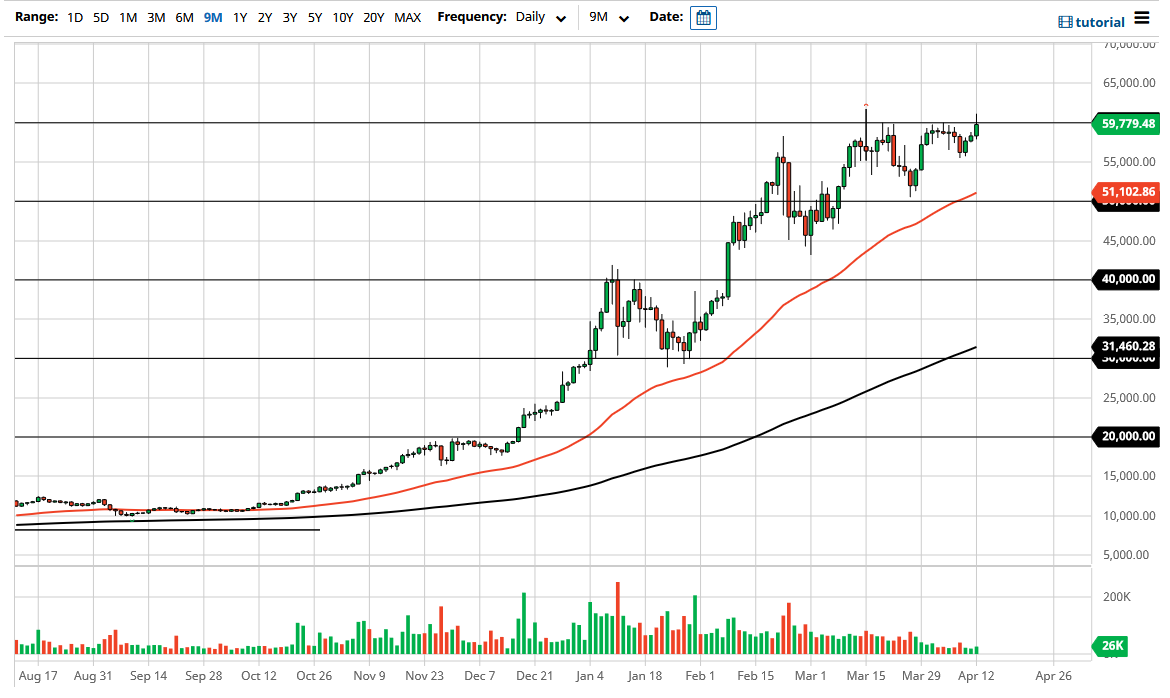

Bitcoin markets have rallied a bit during the course of the trading session on Monday to reach above the $60,000 level. However, that area continues to cause a few issues, as we have also pulled back from there. Ultimately, I think this is a market that will try to extend the rally well above there, but in the meantime, it looks like it is a bit of a fight. With that being the case, I continue to look at short-term pullbacks as an opportunity to take advantage of what should be a continuation of the longer-term trend. I have been waiting to see a daily close significantly above the $60,000 level, and although we do not quite have the candlestick yet, the Monday action was clearly a good sign.

I believe that the $55 level underneath will be massive support, so I think that we should look at dips as potential buying opportunities. After all, the market has been grinding higher for quite some time, and therefore it is only a matter of time before we should see some type of continuation. If we can break above the top of the candlestick for the trading session on Monday, then it would show a significant amount of momentum that the market needs to see. In fact, we are starting to see a bit of an ascending triangle form again, and that of course is a very bullish sign. At this point, the measured move would be about $11,000, opening up the possibility of $70,000, maybe even higher.

Bitcoin is a market that you cannot be a seller of anytime soon because it has been so bullish. However, if we were to break down below the $50,000 level then we may have some work to do. I think given enough time, the market will find value hunters looking to get involved, as we are seen a lot of institutional demand flowing into the market, so that could be thought of as a reason why there might be buyers on dips anyway. For that matter, the market is likely to see more calls for higher pricing, as analysts are now starting to suggest that Bitcoin could go looking towards the $100,000 level above. That being said, you should keep in mind the crypto markets do have vicious pullbacks occasionally