Bearish View

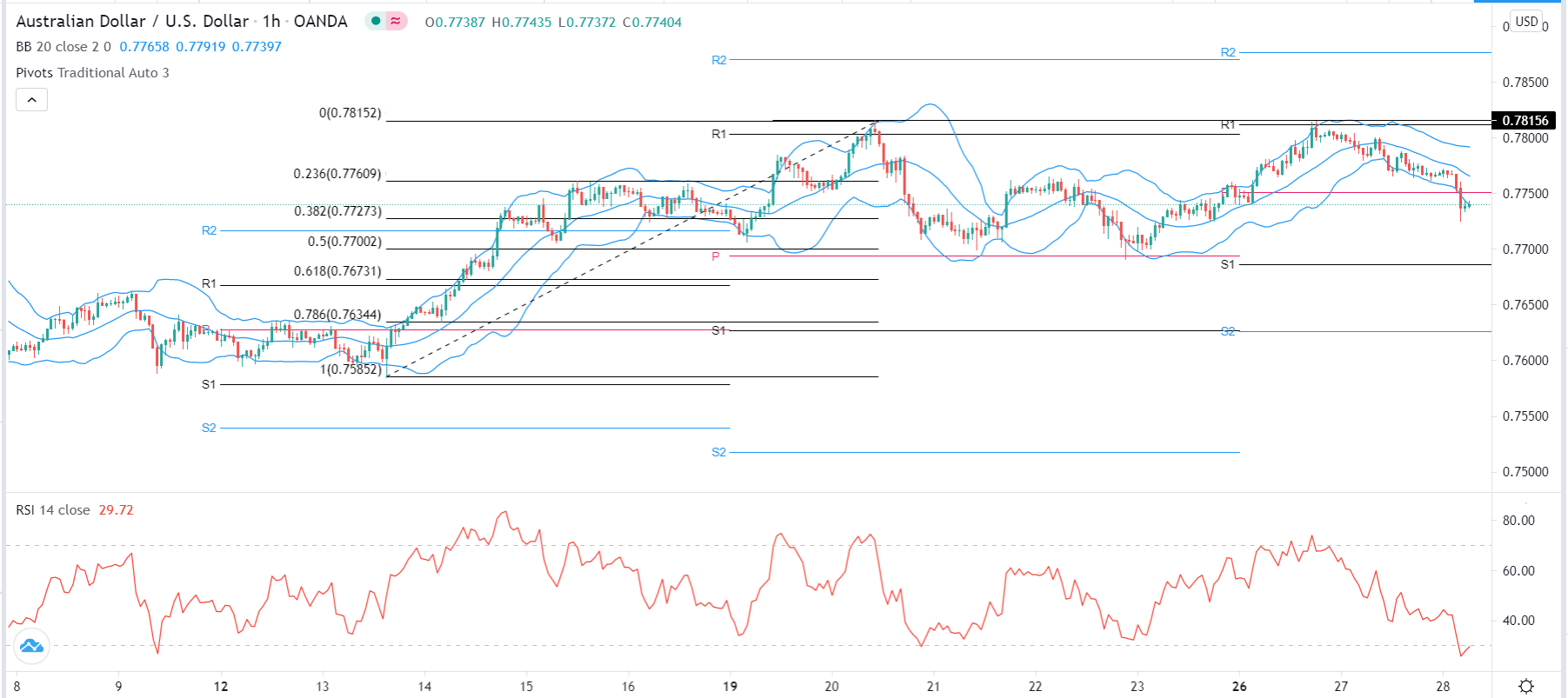

- Sell the AUD/USD and set a take-profit at 0.7686 (standard support).

- Add a stop-loss at 0.7775.

- Timeline: 1-2 days.

Bullish View

- Set a buy stop at 0.7775 and a take-profit at 0.7850.

- Add a stop-loss at 0.7700.

The AUD/USD pair declined during the Asian session as the market reflected on the latest weak Australian inflation data. It is trading at 0.0.7740, which is 0.95% below the highest level in April.

Australian Inflation

The Australian dollar weakened slightly as the market reacted to the latest inflation data from the country. According to the statistics bureau, the headline Consumer Price Index (CPI) rose by 0.6% in the first quarter after rising by 0.9% in the fourth quarter. Analysts were expecting a quarter-on-quarter increase of 0.9%. On an annualised basis, the CPI rose by 1.1% from the previous 0.9%.

The trimmed-mean CPI rose at a year-on-year pace of 1.1% while the weighted mean CPI rose by 1.3%. The two were lower than the previous quarter’s increase of 1.2% and 1.4%.

As such, the country’s inflation is below the Reserve Bank of Australia’s (RBA) target of 2%. It is also substantially lower than that of the United States, where consumer prices rose by 2.6% in March.

The AUD/USD pair is also falling ahead of the latest Fed interest rate decision that will come out later today. The bank is expected to leave interest rates at the range of 0% and 0.25%.

Judging by the past statements by Jerome Powell, the bank will likely leave its asset purchases unchanged as it continues to support the recovery. These purchases have pushed its balance sheet to more than $7.8 trillion, up from below $4 trillion in 2020. Signs of tightening by the Federal Reserve will be bearish for the AUD/USD, and vice-versa.

AUD/USD Forecast

The hourly chart shows that the AUD/USD pair has been on a strong downward trend after it formed a double-top pattern at 0.7815. Along the way, the pair has dropped below the 23.6% Fibonacci retracement level. It is also at the same level as the lower side of the Bollinger Bands, which is usually a bearish sign. The pair has also moved below the standard pivot point while the Relative Strength Index (RSI) has continued to drop. Therefore, at this stage, the path of least resistance for the pair is bearish, with the next key target being at the first standard support at 0.7687. However, a move above 0.7770 will invalidate this trend.