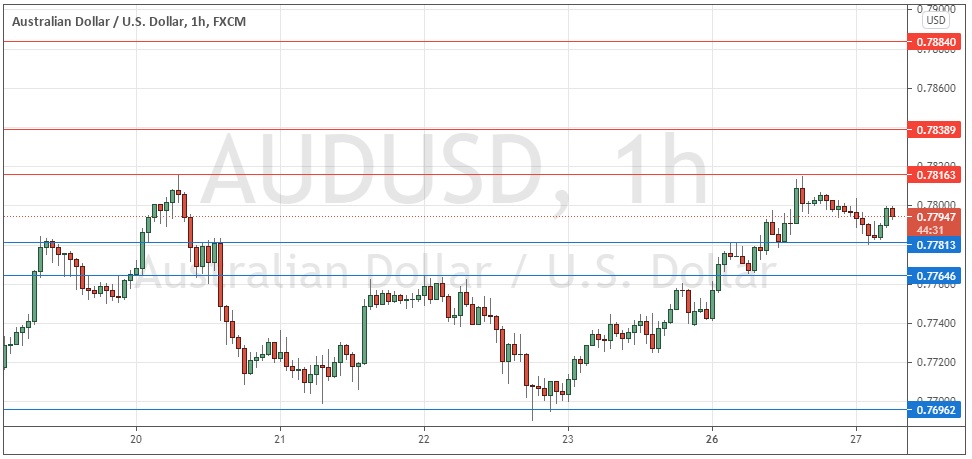

Last Thursday’s AUD/USD signals produced a nicely profitable long trade from the bullish bounce off the support level identified at 0.7705.

Today’s AUD/USD Signals

Risk 0.75%

Trades must be taken prior to 5pm Tokyo time Wednesday.

Short Trade Ideas

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7816, 0.7839, or 0.7884.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

- Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7781, 0.7765, or 0.7696.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

I wrote last Thursday that although the technical picture looked mixed and uncertain over the medium term, we did see some short-term bearish momentum following the bearish reversal from the resistance level at 0.7765 a couple of hours ago, so we may see the price fall here over the day.

This was a good call, as the price spent the rest of the London and New York sessions falling before bottoming out at the support level just above the round number at 0.7700, which gave a great, profitable long trade entry signal.

We now see some bullish momentum here over the past few days, as the Aussie strengthens along with global risk appetite, despite the U.S. dollar’s recovery, suggesting the AUD is a relatively strong currency. The price is moving here with more health than we are seeing right now in major currency pairs.

Technically, the price is close to the key resistance level at 0.7816 which may have already printed a bearish double top at its last peak. The level looks strong and pivotal, suggesting that the best trade opportunity today will either be a short from another bearish reversal there making a triple top, or a long trade from a bullish breakout.

As there is some bullish momentum, I will take a bullish bias if we get two consecutive hourly closes today above 0.7816 on above-average volatility.

Regarding the USD, there will be a release of U.S. CB Consumer Confidence data at 3pm London time. Concerning the AUD, there will be a release of CPI (inflation) data at 2:30am.