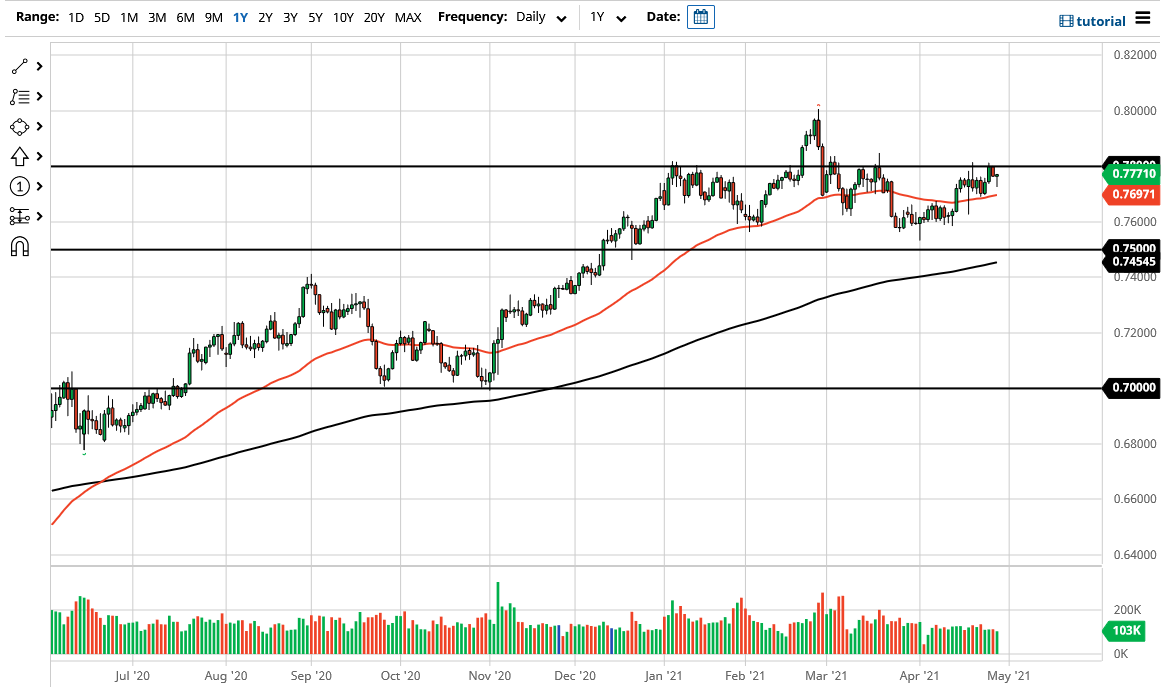

Last Tuesday’s AUD/USD signals produced a profitable bearish reversal from the key resistance level identified at 0.7816.

Today’s AUD/USD Signals

Risk 0.75%

Trades may only be entered before 5pm Tokyo time Friday.

Short Trade Ideas

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7816, 0.7839, or 0.7884.

- Place the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7781, 0.7753, or 0.7725.

- Place the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

I wrote last Tuesday that the price was close to the key resistance level at 0.7816, which may have already printed a bearish double top at its last peak. The level looked strong and pivotal, suggesting that the best trade opportunity today would either be a short from another bearish reversal there making a triple top, or a long trade from a bullish breakout.

This was a great call, as I was completely correct about how strong and important that level at 0.7816 would be. The price made a bearish reversal there, printing the triple top discussed.

The price chart below shows we have a clearly ranging, consolidating technical picture, with the price moving between 0.7816 and 0.7697 with wide, clear swings. The action is ranging, but there are still trade opportunities from reversals at the extremes of the range.

Although we have a consolidation, there are good reasons to take a slightly bullish bias on it, due both to the price action, and the fact that risk sentiment globally is generally positive, which should boost the Aussie.

Therefore, I will still be happy to take a bullish bias if we get two consecutive hourly closes above 0.7816, but I would also take a short trade from a bearish reversal there. I would also take long trades from any bullish bounce at 0.7753 due to its confluence with a major quarter-number, or 0.7725.

Regarding the USD, there will be a release of U.S. Advance GDP data at 1:30pm London time. There is nothing of high importance scheduled today concerning the AUD.