Bearish View

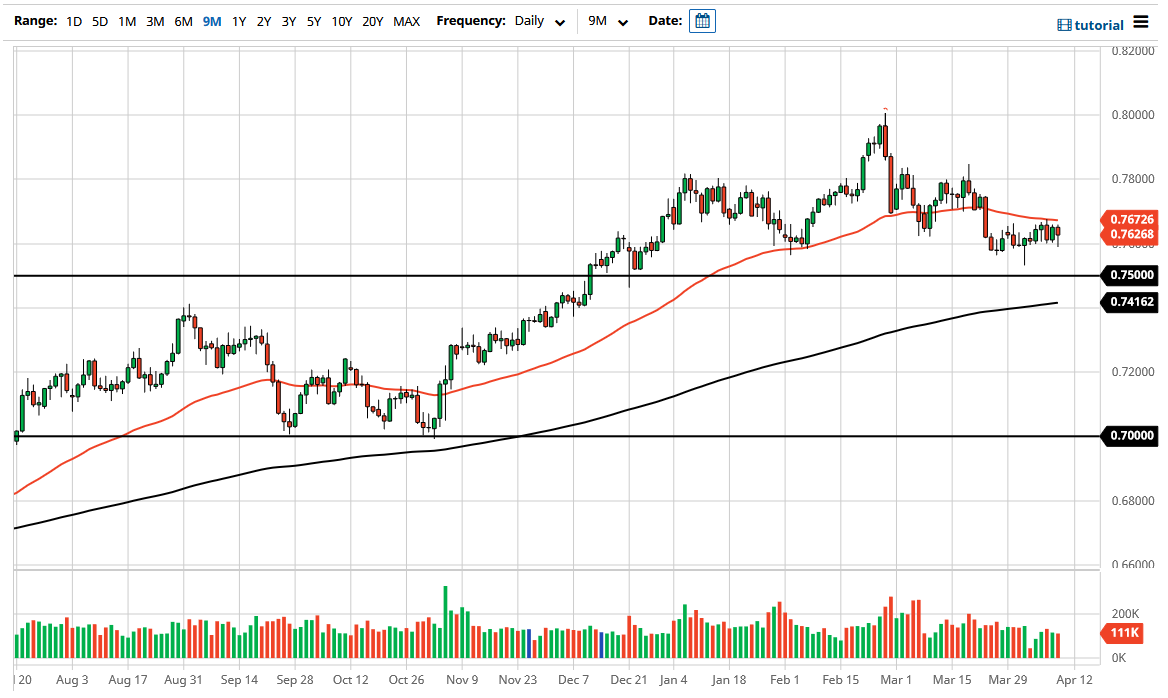

Set a sell-stop at 0.7588 (Friday low).

Add a take-profit at 0.7500 and a stop loss at 0.7625.

Bullish View

Set a buy stop at 0.7625 (Friday high).

Add a take-profit at 0.7700 and a stop-loss at 0.7580.

The AUD/USD price dropped by 0.30% in early trading as top commodity prices dropped and as Australia abandoned its vaccination schedule. It dropped to 0.7598, which is 1% below the highest point this month.

Australia Abandons Vaccination Schedule

The Australian government has abandoned its vaccination schedule as worries of the vaccine by AstraZeneca rose. In a report last week, the Australian Technical Advisory Group on Immunisation urged the government to reserve the vaccine to people who are above 50 because of the blood clots concern.

In a statement during the weekend, Prime Minister Scott Morrisson said that the government would likely not achieve its ambition to vaccinate 25 million people this year. This raises concerns that the economy will not recover as fast as analysts were expecting. Specifically, the important services sector that depends on a quick vaccination rollout could be affected.

The AUD/USD also declined because of the decline of commodity prices. Gold prices fell by 0.35% while copper and iron ore prices fell by more than 1%. This decline was mostly because of a surge in coronavirus cases in some countries, including the United States. The Aussie is often seen as a proxy for these commodities.

There is no scheduled economic data from Australia today. Therefore, traders will focus on tomorrow’s new home sales and business confidence data. Also, China will publish the important exports and imports numbers for March tomorrow. These numbers are closely watched because China buys most of Australia’s goods and services.

Most importantly, the AUD/USD will react to the US Consumer Price Index data. Economists expect the data to show that the overall CPI rose from 1.7% in February to 2.5% in March because of the recent stimulus package. On Friday, data by the Bureau of Labour Statistics revealed that the country’s Producer Price Index rose by more than 4%.

AUD/USD Technical Analysis

The hourly chart shows that the AUD/USD pair has tilted lower recently. It is trading at 0.7598, which is slightly below the 25-day and 15-day exponential moving averages (EMA). The price is also along the lower line of the Bollinger Bands while the Relative Strength Index (RSI) has been on a downward trend. Therefore, the path of least resistance for the Australian dollar is lower, with the next level to watch being at 0.7588. A drop below this level will be a sign that bears have prevailed and that the price will keep falling as bears attempt to move below 0.7500.