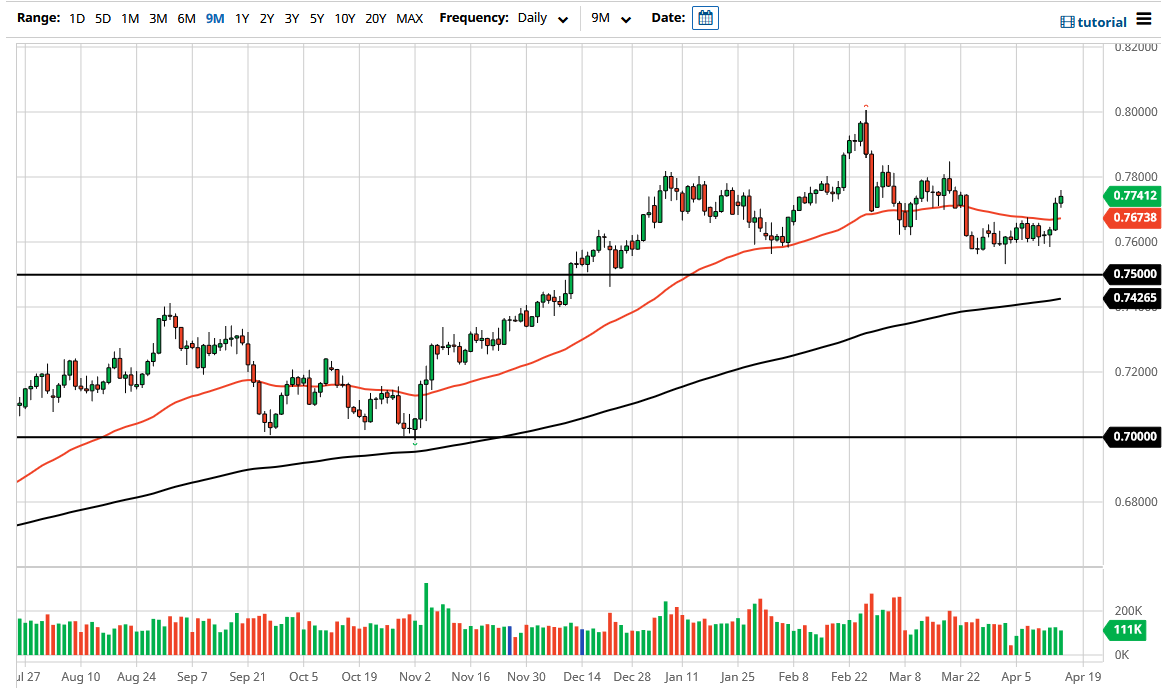

The Australian dollar has rallied slightly during the trading session on Thursday as we are looking towards the 0.78 level above. Ultimately, the 0.78 level has been a significant amount of resistance previously, so it is possible that the market is trying to break towards that level and test it for resistance. The 0.78 level above being broken would be a very significant turn of events, sending the market towards the 0.80 level, as it is a significant large, round, psychologically significant figure.

Beyond all of that, the 0.80 level is a huge level on the monthly charts, that extends to the 0.81 handle, opening up the possibility of moving all the way to the 0.90 level if we leave that resistance barrier behind. That being said, it is difficult to imagine a scenario where we sliced through all of that easily, and we most certainly have a lot of work to do to get there. All things being equal, the market is likely to see a lot of choppy behavior, and perhaps a significant amount of resistance in the 0.78 level before pulling back a bit. The 50 day EMA underneath should offer significant support, and if we were to break down below there it is likely that the market goes looking towards the 0.76 handle. The 0.75 level underneath is massive support, and if we break down below there it could really break this pair down.

The last couple of monthly candlesticks have been shooting stars, that typically spells bad news for the market going forward. However, if we were to break above both of them, that would be one of the most impulsive move that I can think of for the upside. This is a market that I think given enough time will have to make a bigger decision, and I think the 0.78 level is the next area we need to judge significantly. All things being equal, the last couple of candlesticks have been very impulsive and very strong, but we still have a lot of work ahead of us in order to make all of that happen. All things been equal, this is a market that I think continues to see a lot of questions being asked in the short term to determine where we go in the long term.