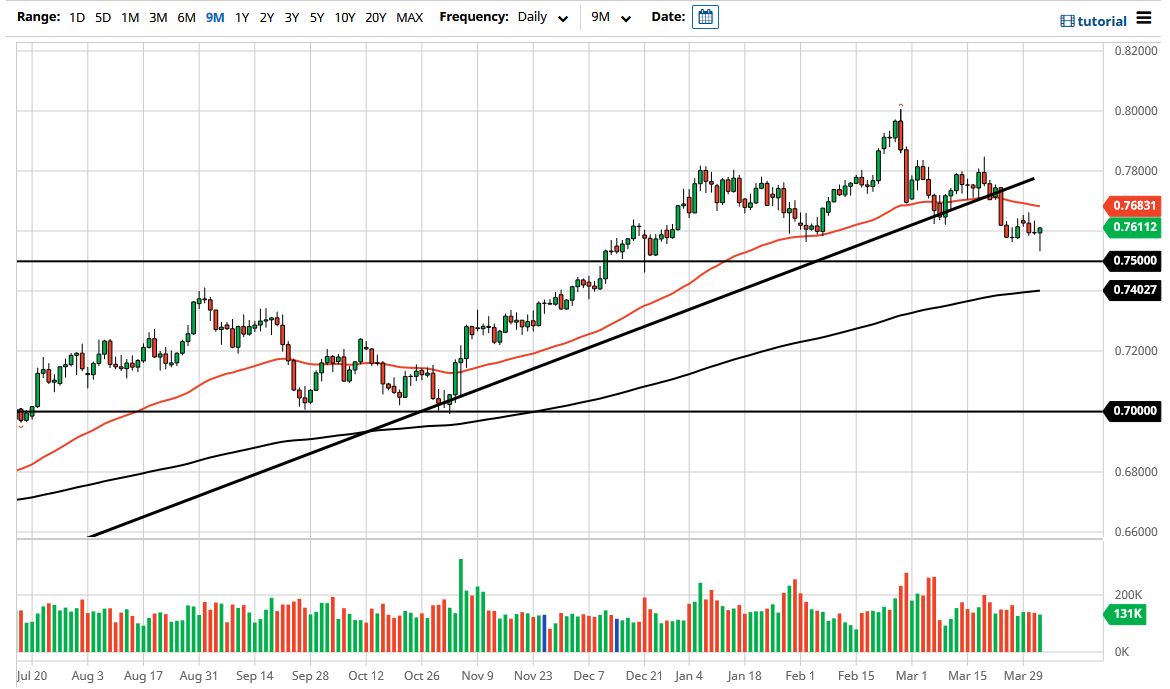

The Australian dollar has initially fallen during the trading session on Thursday but turned around to show signs of strength as the yields in America started to drop again. That being said, the market is likely to see a lot of movement based upon the interest rates going back and forth, so keep that in mind as we move forward. That being said, the market has ended up forming a hammer, but it is also worth noting that it formed several bearish candles ahead of forming this one. The question now is whether or not we continue to see those yields dropped, or if they spike again?

With that being Good Friday, it is very unlikely that the bond market moves drastically, so it will be interesting to see how this plays out. I think this is a market that will continue to be very noisy, because we have on one hand the idea of the reopening trade pushing commodities higher, but we also have to worry about the yields going back and forth and driving money back into the US dollar. All things being equal, we have to look at the recent break down as a potential sign of trouble, but you also can make the argument that the Thursday candlestick is very impressive. The 0.75 level underneath is a large, round, psychologically significant figure, so of course it makes sense that there would be a little bit of support there. However, there are a lot of signs out there that perhaps we could see another spike higher in interest rates.

Most traders believe that the interest rates on the 10 year note will reach 2%, which makes a strong and compelling argument for a stronger US dollar. That being said, it will be interesting to see what the rate of change is because that is one of the biggest drivers of fear when it comes to getting too far away from the greenback. That being said, the Aussie clearly is putting up a strong fight. With this being the case, I anticipate that the next 24 hours will be very choppy, especially as the Americans will be away for the session, meaning that most of the action will be very early in the day.