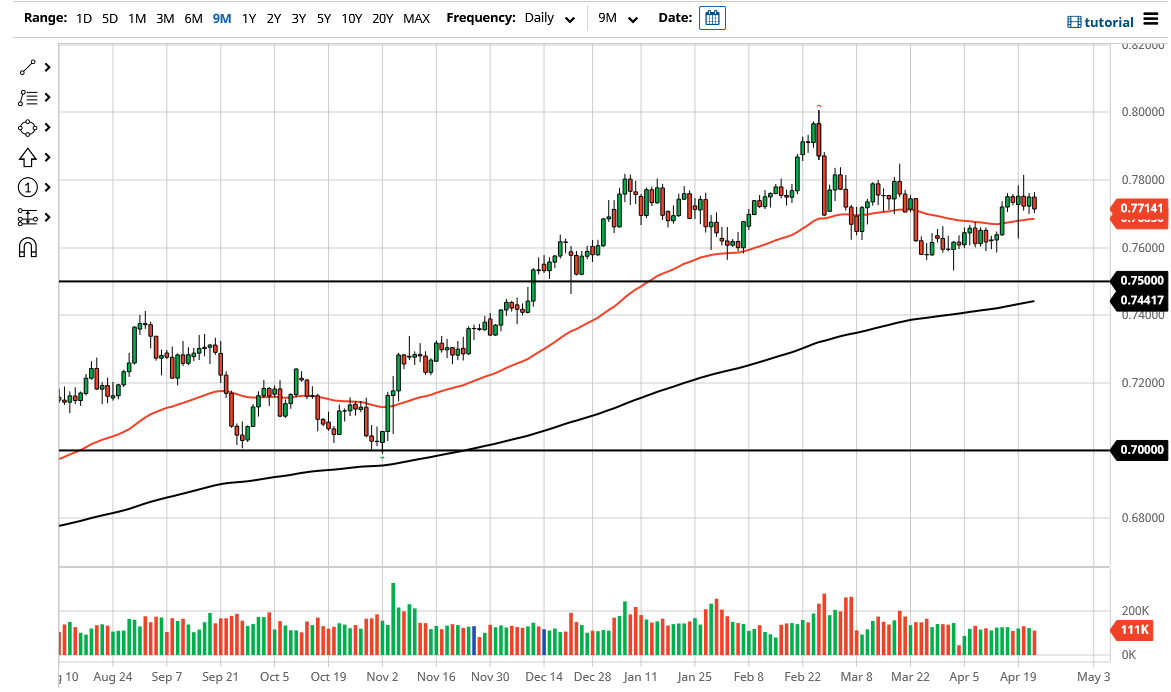

The Australian dollar has pulled back against the greenback during the trading session on Thursday again, but still sees plenty of support underneath at the 50 day EMA to keep the market afloat. That being the case, the market is likely to continue to see a lot of choppy and sloppy behavior, because quite frankly it appears that the pair has nowhere to be anytime soon. Obviously, we cannot jump into this market with any size now, because quite frankly we just do not know what to do. The Australian dollar recently has been chopping around as we are starting to question things like the reopening trade.

Furthermore, it is worth noticing that the February and March candlesticks on the monthly timeframe were both shooting stars, and that suggests that perhaps we may have a little bit of trouble ahead as the 0.78 level has obviously been a massive barrier to buyers. In fact, I am starting to wonder whether or not the market is being “held hostage” buying the latest coronavirus figures, because we are starting to see them rise in places like Japan and India. If Asia starts to fall again, and we start to see more lockdowns, that could be very bad for the risk appetite trade, which by extension is bad for the Aussie. Furthermore, the Aussie is essentially the proxy for a lot of Asia when it comes to Forex trading.

That being said, we should pay close attention to the 0.78 level bone, because if we can break above there then this pair is very likely to continue going much higher. At this point, the market is going to end up seeing a lot of headline noise, so if we do get a lot of negativity suddenly, the 0.76 level might be the target. There is an area of support between 0.76 and 0.75, so breaking down below their opens up a massive black hole of selling from what I can see. At that point, I would be looking at the 0.71 handle for a longer-term trade. The market certainly looks as if something big is going to happen eventually, but right now we are simply spinning our wheels trying to figure out where that is going to be. I suspect you will see a large impulsive candle in one direction or the other to tell you which way we are going to break.