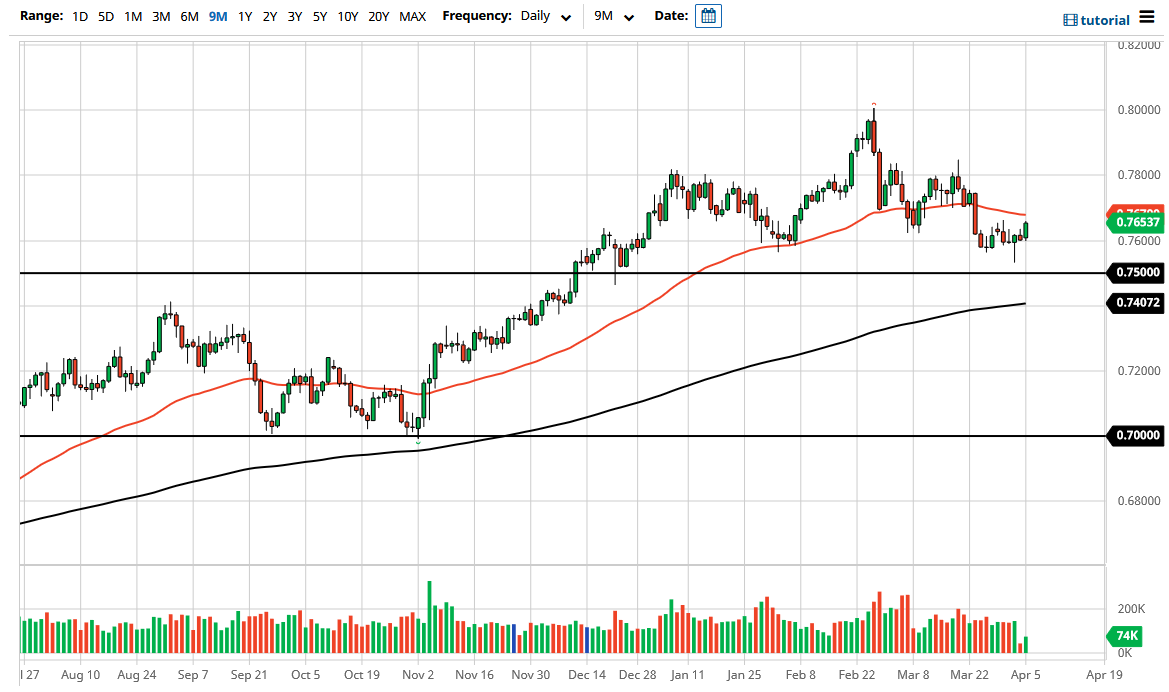

The Australian dollar has rallied on Monday as traders came back to work, reaching towards the 50 day EMA. With that being said, the market is trying to base, but the question now is whether or not we need to pay close attention to the monthly candlestick? We do in my estimation, as the February and March candlesticks were both shooting stars, showing signs of exhaustion. I think at this point it will be interesting to see this plays out but when we look at the higher time frames, it is clear that the Australian dollar has major problems once we get close to the 0.80 level.

In fact, the 0.80 level extends all the way to the 0.81 handle on monthly charts as a potential barrier. Whether or not we can get above there might be a completely different question, but it is worth noting that this juncture. The market could be a “sell on the rallies” type of situation, at least on signs of exhaustion. In the short term, it is a little bit different, because the candlestick from the Monday session was of course so bullish, as we are closing towards the top of the range and just underneath that crucial 50 day EMA.

To the downside, the 0.75 level underneath is a major support barrier, and therefore I think that the market breaking down below there would send in fresh selling, despite the fact that the 200 day EMA is sitting that the 0.74 level. That could cause a little bit of a bounce, but at the end of the day it makes more sense that the market would go looking towards the 0.71 based upon the “measured move” of the head and shoulders pattern that has recently broken down.

We are between the 50 day EMA and the 200 day EMA indicators, which when they start to squeeze together can cause quite a bit of noise. The Australian dollar is highly sensitive to the commodity markets, and of course the entire “inflation trade” that so many traders are focused on right now. Pay close attention to the yields in the United States because they have also been crucial as determining whether or not the US dollar is strengthening. If the yields in America continue to grind higher, that probably will put a little bit of a weight around the neck of the Aussie.