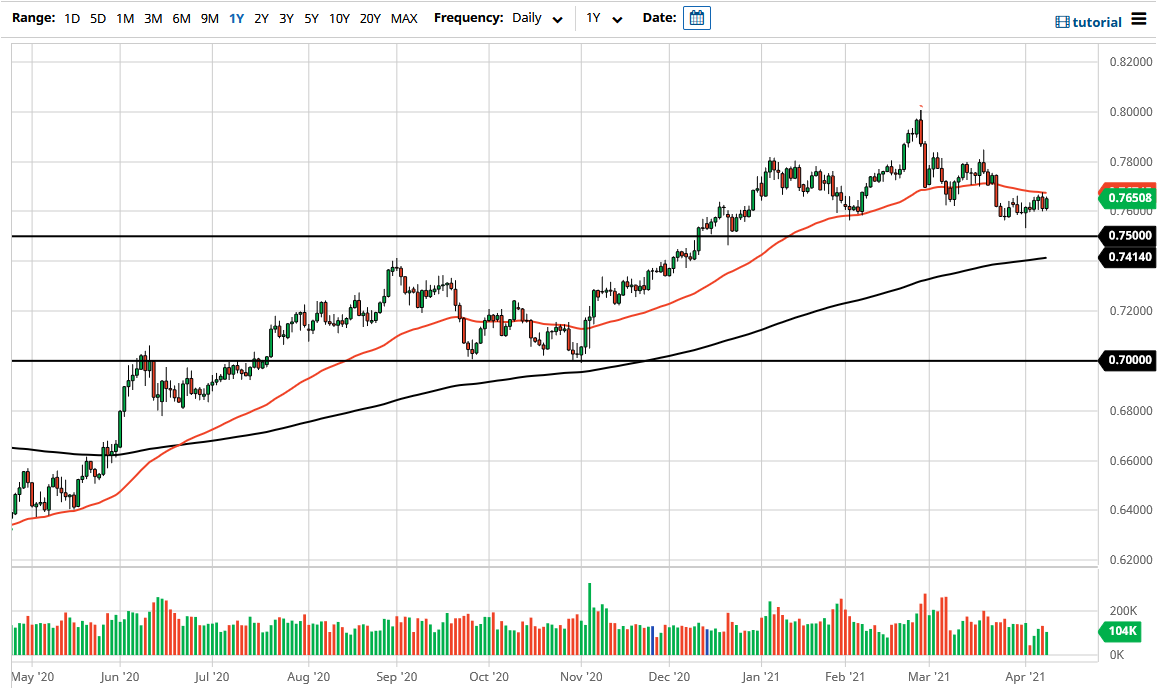

The Australian dollar has rallied a bit during the course of the trading session on Thursday to reach towards the 50 day EMA above. This is something that we have seen repeatedly over the last several weeks, as the market is going back and forth trying to figure out where to go next. I find this interesting, due to the fact that we have seen the 50 day EMA to be so important and has caused the market to react multiple times. That being the case, I have to assume that it will continue to cause reactions.

Looking at this chart, you can see that the 0.75 level underneath has offered support recently, as we had bounced from there. That being said, the market also sees a lot of resistance above, due to the fact that we have seen the shooting star from February look negative, and then after that we have seen the market candlestick form a shooting star. With a couple of shooting stars in a row, that would be a very negative sign for longer-term trading.

If we do break down from here, it is very likely that we could go to the 0.71 handle. The 0.71 level begins significant support down to the 0.70 level, but what I would look at is a scenario where you need to pick your battle, and at this point I think we are simply trying to find some type of catalyst to get moving. The interest rates in America have been rising for some time, and therefore it does suggest that perhaps the US dollar could get a little bit of a bounce. Nonetheless, we can simply follow price action at this point to try and get a handle on where we are going next, and therefore I think that if we break above the 50 day EMA on a daily close, we may make a run towards the 0.78 handle. Breaking above there opens up the possibility of a move to the 0.80 level, which of course is a large, round, psychologically significant figure and an area that matters on monthly chart.

All things been equal though, based upon the most recent price action it certainly looks as if the Australian dollar is struggling to bet and I think we could see a bit of continued downward pressure given enough time.