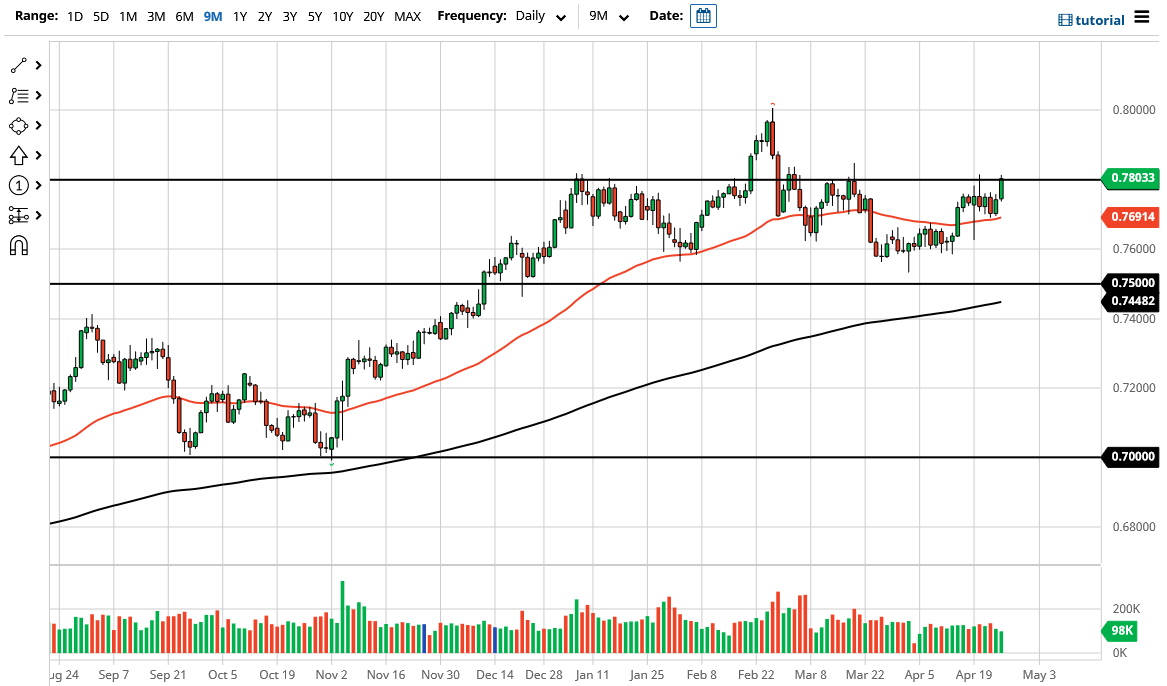

The Australian dollar rallied significantly during the trading session on Monday to test the 0.78 level again. That is an area that has been massive resistance previously, and it is worth noting that we stopped there. That being said, the market is closing in an area that it has not been able to for some time, so the question now is whether or not we can continue to go higher. I suspect that if we break above the 0.7850 level, the Australian dollar will then go looking towards the 0.80 level.

The 0.80 level is a huge barrier that extends 100 points. In fact, this is such a huge barrier that it goes back multiple decades as a major point of contention. If we were to break out above the 0.81 handle, then this is more or less going to be a “buy-and-hold” type of situation. This will come down to the US dollar in general, as the greenback has been under assault for some time. The Australian dollar will be a beneficiary of that because the idea is that the “reopening trade” comes into play and traders will take advantage of commodity currencies.

It is worth noting that the Aussie has not broken out yet while the Canadian dollar looks hell-bent on breaking through all kinds of barriers. You could say the same thing about the New Zealand dollar, at least that it looks like it has an easier route higher. Perhaps this comes down to the bickering between Australia and China, or perhaps something else is going on. It will be interesting to see this plays out, because Australia continues to suffer at the hands of lockdowns, although the currency itself is typically used as a proxy to China and commodities overall.

From a longer-term standpoint, the February candlestick is a shooting star, and the March candlestick is somewhat similar. In other words, there seems to be a lot of selling pressure just above. Ultimately, this is a market that certainly could break down, but there needs to see a significant amount of US dollar strength via the bond market or some type of major “risk off” type of situation to really get that off. Keep in mind that the next couple of days feature the Federal Reserve meeting, so there is the possibility of a headline risk.