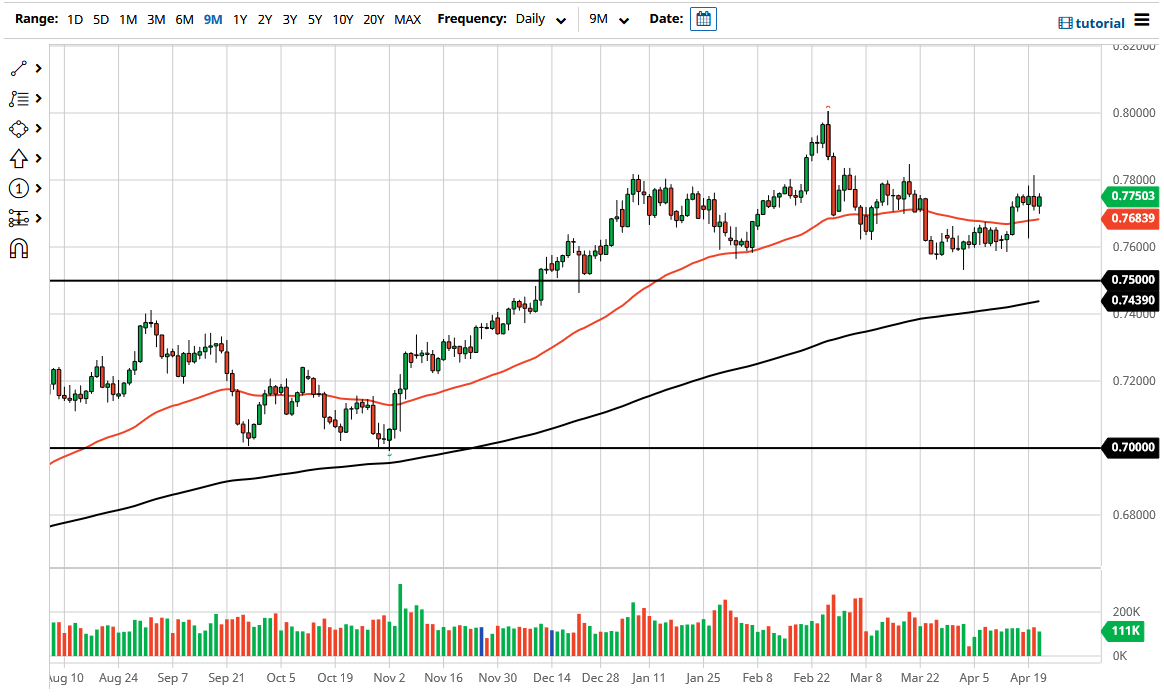

The Australian dollar initially dipped during the trading session on Wednesday but then turned around to show signs of strength again. This is a question as to whether or not we are going to build up enough momentum to get a breakout or breakdown of the tight range that we are currently stuck in. At this point, the market is trying to figure out whether or not we are going to continue the “risk on” move, or if we are going to completely fall apart.

That being said, it is worth noting that the February and March candlesticks were both shooting stars, so that does tend to have money looking for a longer-term decline, but recent price action has been extraordinarily stubborn, so it still a question as to whether or not we actually are going to fall apart. This is all about the US dollar at this point, so you should need to keep an eye on the greenback overall and risk appetite. If we continue to see a lot of traders pile into the “reopening trade”, then that should help in lifting the Australian dollar due to the fact that it is so highly levered to commodities, which are doing quite well, and the idea of China producing “things” for the rest the world.

On the other hand, if we continue to see a lot of people out there concerned about coronavirus, that could put downward pressure on the market. After all, the greenback is considered to be a “safety currency”, and if people are concerned about the markets and the global economy, then they will typically go to the safety of bonds.

Underneath, I see the 50-day EMA as significant support, and breaking below there I think would open up a move down to the 0.76 handle. After that, we have support extending down to the 0.75 handle, so clearing that to the downside then opens up a massive sell-off, probably something in the order of the 45 handle. On the other hand, if we were to break above the 0.78 handle, it could open up a move to the 0.80 level, which is a massive resistance barrier on the monthly charts. In other words, we are most certainly in a major inflection point, which might suggest why we are going sideways over the last couple of months.