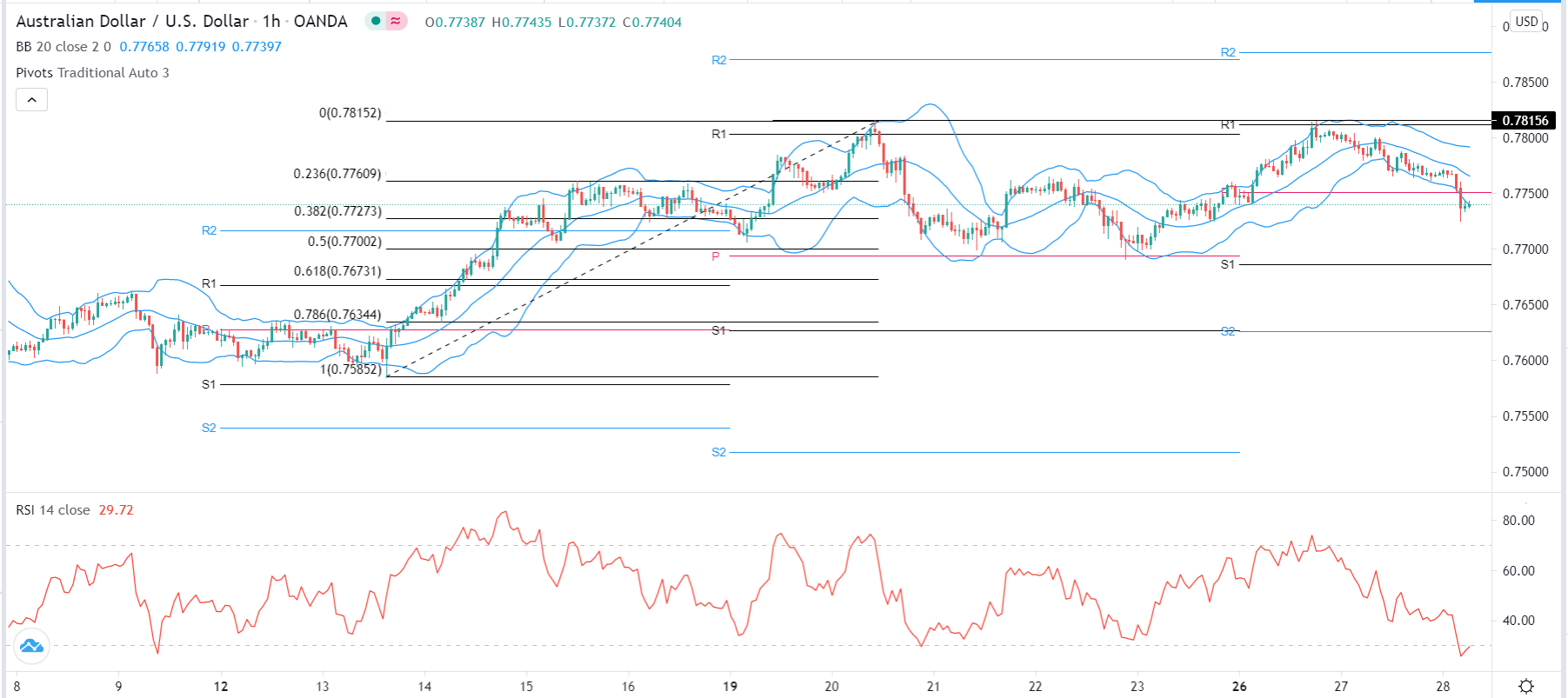

The Australian dollar has struggled at the 0.78 level again as the candlestick on Tuesday was negative. This is very interesting, due to the fact that the market has pulled back from there multiple times, and it does look like, at the very least, we are going to continue to chop back and forth. Underneath, we have the 50-day EMA coming into the picture at the 0.7694 level, and that could be a target for sellers. If we were to break down below there, it is likely that the market will start to test several support levels underneath.

Breaking below the 50-day EMA opens up a bigger move to the 0.76 handle, which I think it extends all the way down to the 0.75 level as far as a support zone is concerned. That is major, but if we were to break down below all of that it is likely we could go much lower. When you look at the monthly chart, the Australian dollar has formed a major shooting star for the month of February, and then a similar type of candlestick during the month of March. This tells me that the market will continue to hear a lot of noise above, and I think it does suggest that you need to be very cautious about getting “too long” of this market.

That being said, even if we broke down to the 0.70 level, which would be a huge move, the fact is that the trend would still simply be retracing, as the market has been a bit overdone until recently, and it is worth noting that the last couple of months have been choppy and it looks a bit confused. When you look to the upside, the 0.80 level is a massive resistance barrier that extends all the way to the 0.81 handle. Breaking above that level would be a huge victory for the buyers, and at that point I would not only be a buyer of the Australian dollar, but I would go looking towards the 0.90 level above, based upon the previous long-term technical charts. In fact, at that point I would not only be a buyer, but I would be adding to the position as we went higher because it is such a major breakout if that happens.