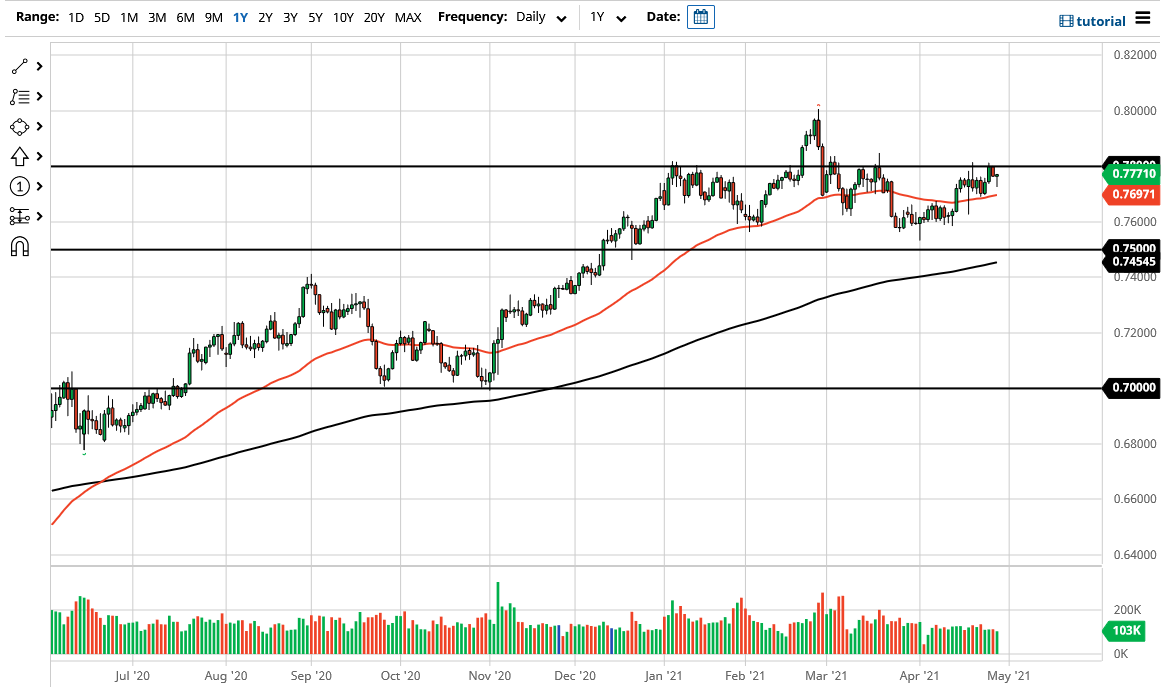

The Australian dollar fell a bit during the trading session on Wednesday only to turn around and form a bit of a hammer. By forming the hammer, the market essentially shows that there are plenty of buyers underneath trying to push this market higher. Currently, the 0.78 level is acting as a major resistance barrier, but as you can see, we have failed to break above there multiple times. If we were to break above there, then the market would go looking towards the 0.80 level above, which is a massive selling area. In fact, that is an area that extends all the way to the 0.81 handle, based upon the monthly charts.

If we were to break above that level, then it is likely that we would continue to see a lot of pressure in general, sending this market much higher. I would have a target of 0.88 at that juncture, becoming more of a “buy-and-hold trader” in the Australian dollar, perhaps even adding on every time it pulls back just a bit. This is a market that looks as if it is trying to break out to the upside, but it is also worth noting that the February candlestick was a massive shooting star, just as the March candlesticks left a lot to be desired. In other words, the market still has a significant amount of noise just above that could cause some issues, and I think you will continue to see a lot of choppy behavior in the short term.

Granted, the Federal Reserve is doing massive amounts of quantitative easing and is probably only going to do more before it is all said and done. I recognize that the market is trying to cause interest rates to rise, but it has got a lot of work to do before that comes into the equation here. That being said, if we were to break down below the 50-day EMA, it could send this market down to the 0.76 handle, possibly even followed by the 0.75 handle. It is upon breaking that level that the uptrend of the Australian dollar becomes quite a bit threatened, perhaps opening up another 50-pips loss. In the short term, I suspect that we are just simply going to grind sideways with more of an upward bias.