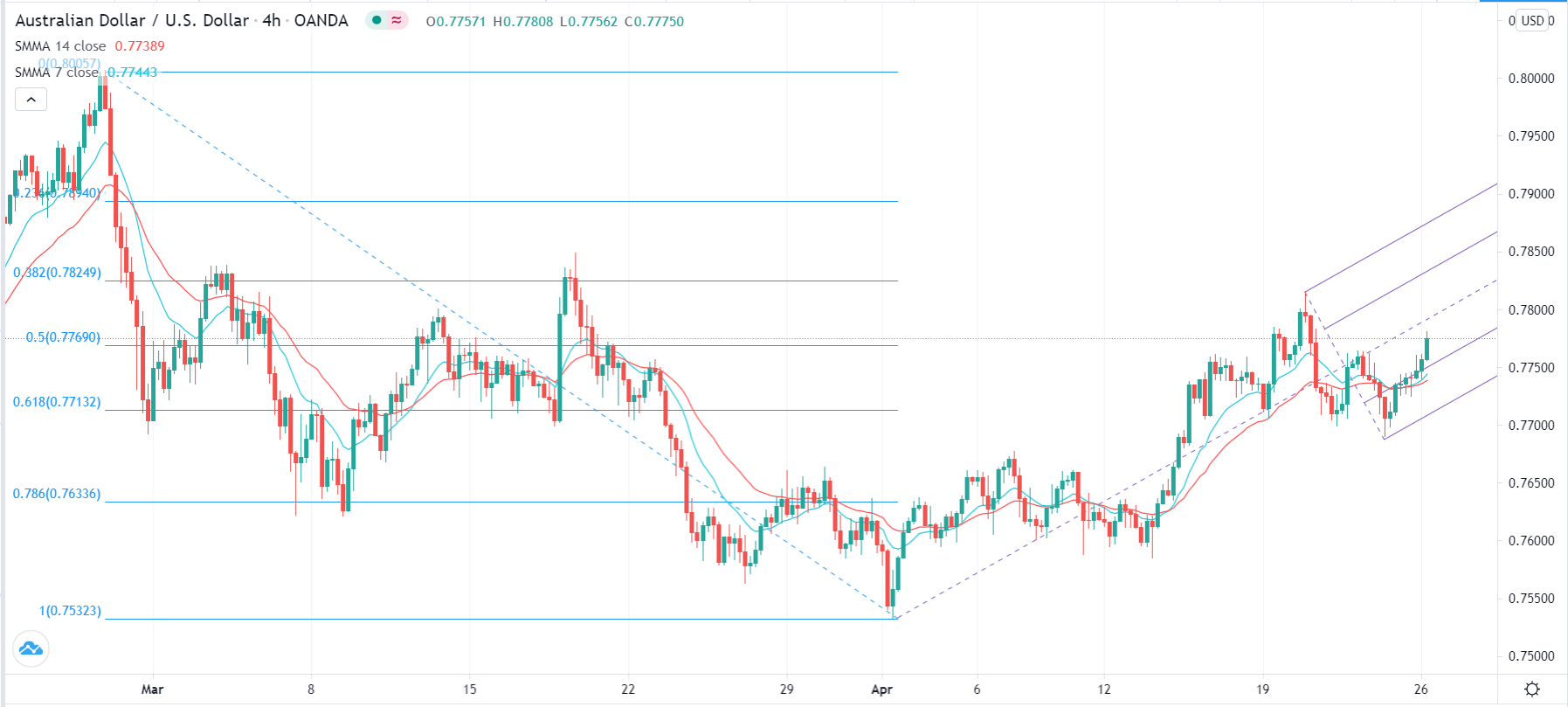

The Australian dollar rallied a bit during the trading session on Friday, as we continue to see the 0.7750 level as a bit of a magnet for price. We did see the 50-day EMA offer enough support to cause a bit of a bounce, just as we have seen over the last couple of days. Ultimately, I think this market needs to make a longer-term decision, but we are not quite ready to do so yet. The 0.78 level above is a massive resistance barrier, so I think it will be difficult to break out above there. If we do, then I would pay close attention to this market, because it could open up the possibility of a move towards the 0.80 level.

The 0.80 level is an area that needs to be paid close attention to, because it could open up a bigger move towards the 0.90 level over the longer term. The 0.80 level has been massive on the monthly charts, and this support/resistance barrier has been in effect for decades. Because of this, I think you will need to pay very close attention to what happens in that general vicinity.

On the other hand, if the market were to break down below the 0.76 handle, we could threaten the 0.75 level again, which would be an extraordinarily negative turn of events and could send this market much lower, perhaps as low as the 0.71 handle. What is obvious with this pair is that we continue to see a lot of questions asked about the reopening trade, as the Aussie dollar is so highly levered to the reflation trade.

This is a pair that is being threatened to the downside but has also shown a lot of resiliency. At this point in time, I think you should simply anticipate more of a back-and-forth type of market than anything else. Eventually, we will have to make a bigger decision, but clearly, we are not ready to do so yet. This weekly candlestick ended up being a shooting star, just as the February candlestick was, and just like the market candlestick is. This is a market that still faces a lot of headwinds and you need to be cautious about your position size.