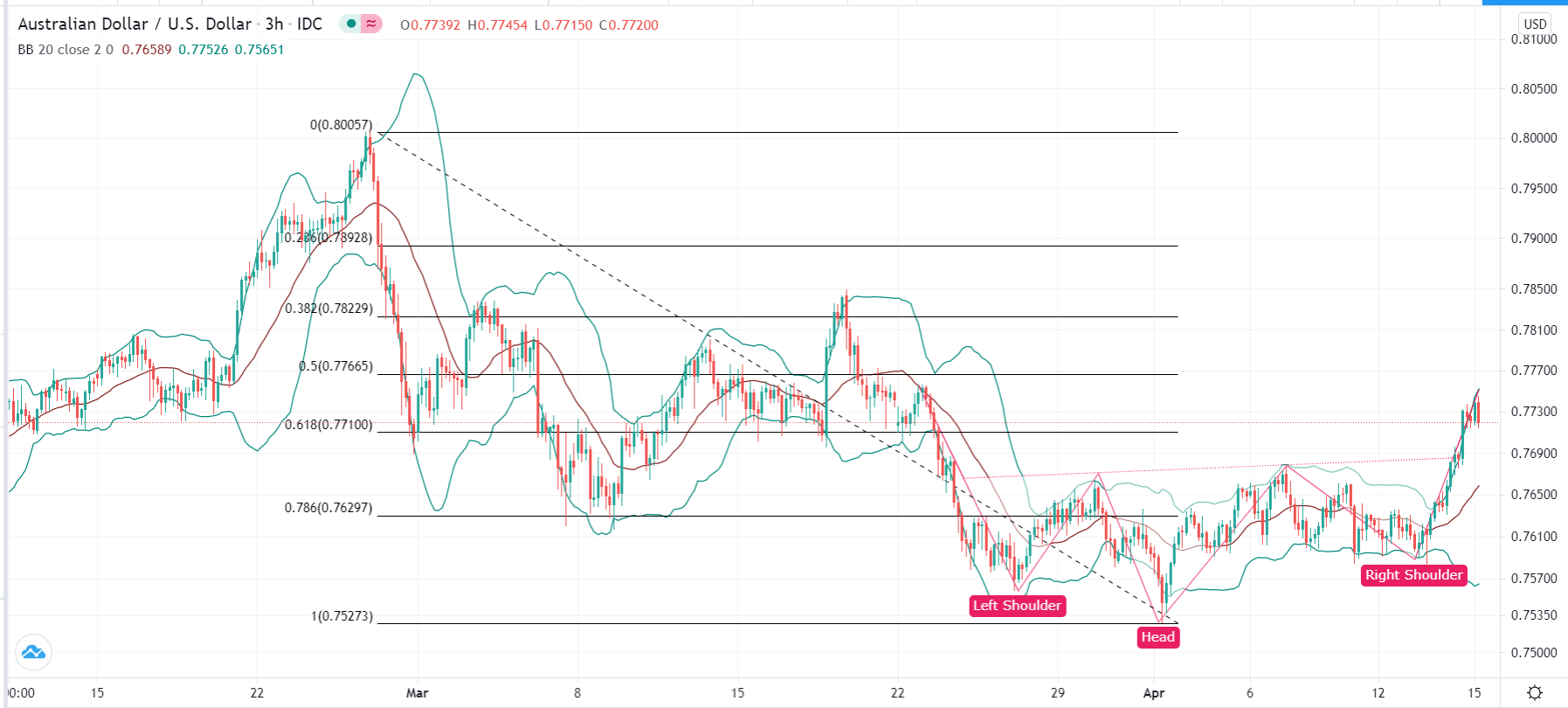

The Australian dollar rallied significantly during the course of the trading session on Wednesday, but it does have a significant amount of noise just above that could come into play and cause some issues. Because of this, I think what we are looking at here is the possibility of some type of pullback towards the 50-day EMA before we continue to climb. This is mainly due to the longer-term action that we had seen previously. What I mean by that is the fact that the 0.7750 level - and most certainly the 0.78 level - have both been areas where we have seen a lot of selling pressure. When you look at the monthly chart, there are clearly some warning signs.

The February and March candlesticks both are shooting stars, and that typically means something. This is not to say that we necessarily have to collapse, but I would anticipate that we are going to see some type of short-term pullback. When you look at the longer-term charts, we could drop all the way to the 0.71 level without really changing too much from a longer-term perspective. Because of this, I think that we are looking at a scenario where traders will be interested in buying some type of pullback in order to pick up value. We have obviously seen a very explosive move during the trading session on Wednesday, but still have not taken out significant resistance above. Because of this, I think it is only a matter of time before we would see some type of pullback.

If we break down below the 0.75 handle, I think that it is a bit of a “trapdoor” that opens up for the market. On the other hand, if we break above the 0.78 level, then it is likely that we would then see the Australian dollar break towards the 0.80 level. The 0.80 level is an area that has been crucial more than once on longer-term charts, extending about 100 pips to the upside. If we were to break above that, then the Australian dollar becomes a “buy-and-hold” currency. At this point though, I do not necessarily think that is going to happen. One thing I think you can count on is a lot of noise, and I would not be surprised at all to see the 0.78 level continue to offer significant resistance. That being said, there is also plenty of support underneath at the 0.76 handle.