The WTI market rallied quite significantly during the trading session on Wednesday to wipe out the losses from Tuesday. Part of this was due to the ship running aground in the Suez Canal, blocking 10% of the world’s oil production from getting to market. Having said that, the market is likely to continue to see a lot of volatility as we had recently seen such a massive move to the upside. That being said, I think that the reaction on Wednesday is something you cannot read too much into, because at the end of the day the Suez Canal will be open in a few short days.

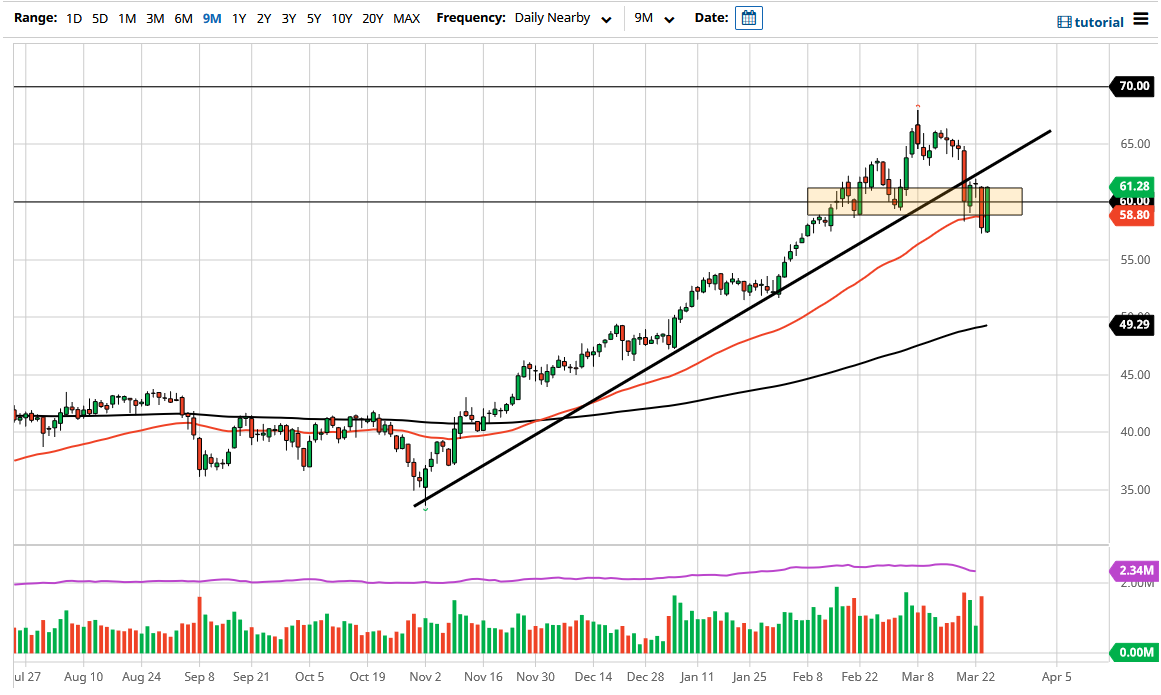

At this point, I believe that we will continue to dance around the $60 level, but the fact that we are starting to see more volatility now and we had previously tells me that the “easy money” has already been made. All things being equal, the market is likely to continue to see a tougher time when try to go higher. All things being equal, the uptrend line that has now been broken below is likely to see resistance formed right there as well, and that being said I do think that the market will more than likely find plenty of sellers just above.

The recent inventory numbers have not been very good for demand pictures, so at this point in time it is very likely that we will see fundamental arguments deteriorate for crude oil going forward. That being said, would not jump in and start shorting right here, because we have such a bullish candlestick. I think we may have a little bit of a bounce ahead of us before seeing exhaustion again that we can start fading. Having said that, if we were to close towards the top of the candlestick and above the previous uptrend line on a daily close, then I might start buying again but ultimately, I think it is only a matter of time before the weight of gravity starts to get involved yet again. If we break down below the bottom of the candlestick, then it opens up the floodgates to go looking towards the $53,000 level. To the upside, the $65 level will be very difficult to get above, as we have seen so much resistance in that general vicinity.