The West Texas Intermediate Crude Oil market rallied a bit during the trading session on Wednesday to show signs of strength again. Reports came out from unnamed sources that the OPEC ministers were going to extend production cuts into April, which drives down a significant amount of supply. On the other hand, if they do in fact decide to increase production a bit, that could drive down the price. Regardless, I do think that the crude oil market is getting close to reaching the highs, because sooner or later shale will come into the picture.

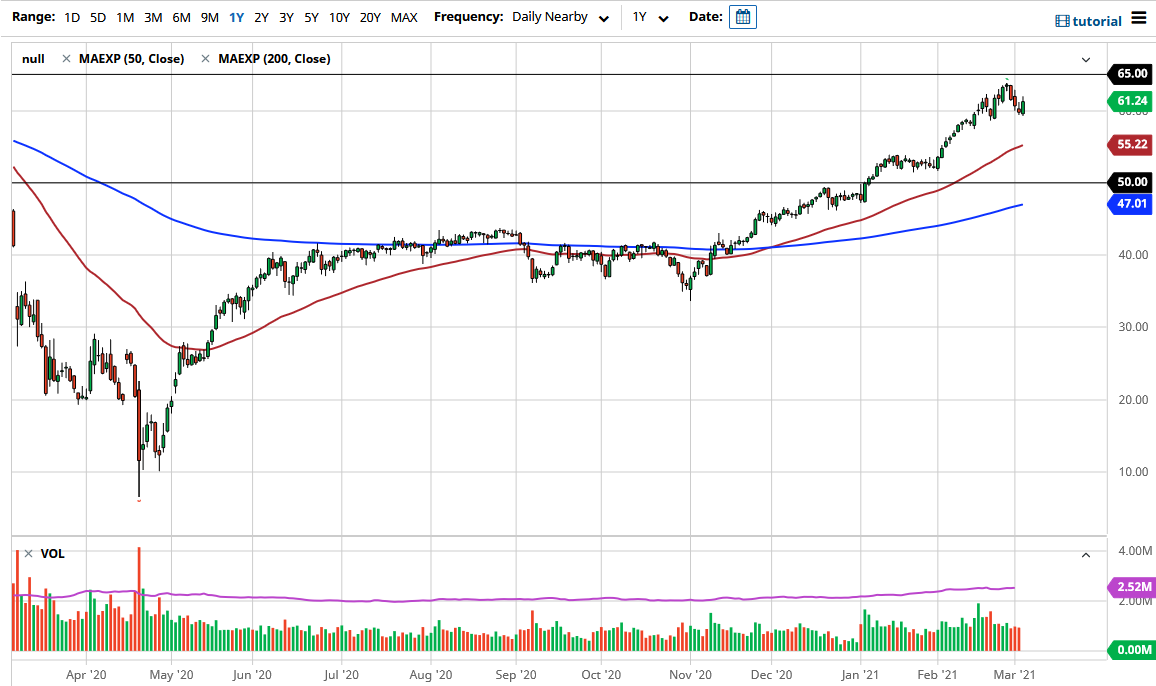

I believe the short-term “ceiling in the market” is probably close to the $65 level. That is an area that is important on longer-term charts as well, because we have seen a lot of selling in that area. With all of that supply, I do think that it is going to be difficult to simply smash through that area. We need some type of catalyst to make that happen, and right now I do not know if we have it. Yes, there is the reopening trade that everybody is involved in, but the short-term pop in crude oil prices is probably already priced in at this point. After all, we are now approaching prices that we were at before the pandemic.

You have to ask yourself one simple question: “Are we in better shape than before the pandemic?” Obviously, we are not. Having said that, I do recognize why the oil market went higher; but given enough time, one would have to think that eventually we are running out of people to buy an asset that has inflated itself so much. When you look at the most recent 30 days, you can see that we have had an impulsive move that was followed by a bit of a megaphone pattern. In other words, we are running out of momentum, so I think it is likely that we could see a real threat when it comes to the overall trend. I am not necessarily thinking that the market is going to suddenly collapse, but I do think that we are going to struggle to get above the $65 level. If we break down below the $59 level, then I think we could drop to the 50-day EMA underneath, which is closer to the $55 level.