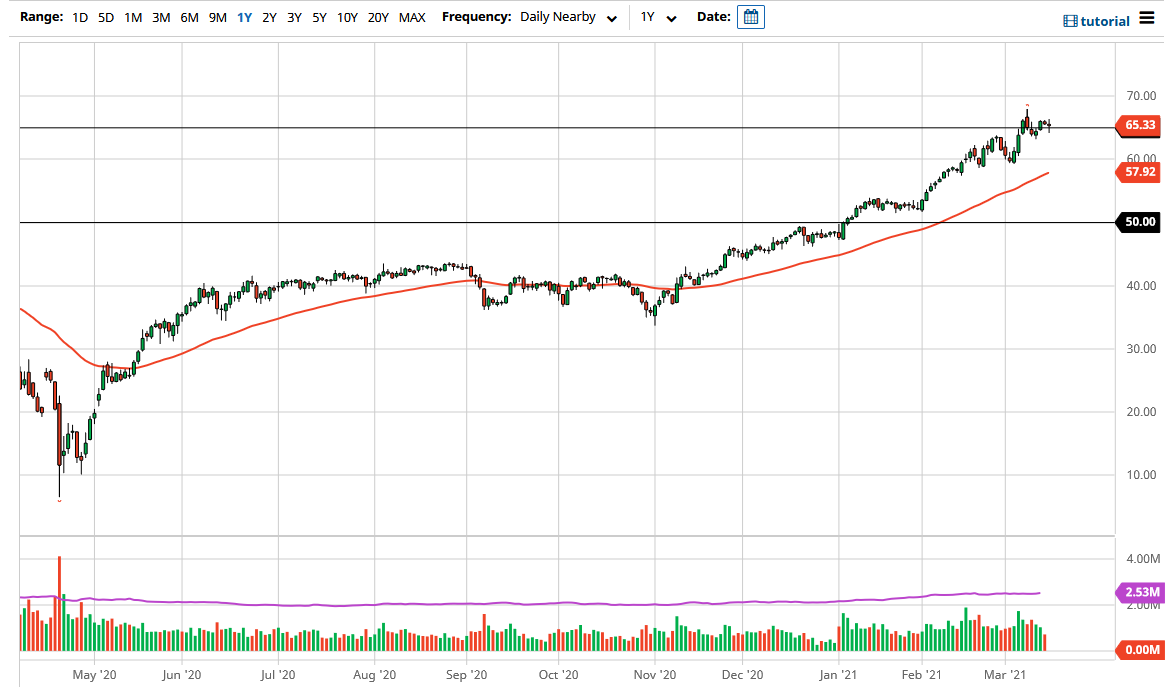

The West Texas Intermediate Crude Oil market has gone back and forth during the trading session on Monday as we continue to dance around the $65 level. The $65 level course is a large, round, psychologically significant figure that a lot of people will be paying attention to, plus it is also an area that we have seen both support and resistance as being significant in the past. As a matter fact, the market has seen a lot of massive selling from this level before the pandemic, so it will be interesting to see whether or not we can truly take off above it.

All things been equal, this is a market that is most certainly bullish, so you cannot look at it as a selling opportunity quite yet, but it is worth noting that there is a lot of noise in this general vicinity. In fact, I suspect that there is quite a bit of noise between here and the $70 level, so I think the market is essentially waiting to see where the momentum comes in.

Later this week, at the end of the day on Wednesday we have the Federal Reserve meeting and perhaps more importantly the statement that will be coming out. I think at this point a lot of people are paying attention to the yield curve more than anything else and as a result the oil markets could make a move based upon what the US dollar does. Having said that, the 50 day EMA is starting to reach towards the $58 level, perhaps reaching towards the $60 level. It is because of this that I think if we turn around a break down below the $60 level, it would be a massive trend change. In the short term though, I think we are simply going to go back and forth around the $65 level, without much in the way of a catalyst between now and close on Wednesday.

Beyond all of this, if we do break out above the $70 level, then I believe at that point the market is free to go much higher, perhaps reaching towards the $75 level. Currently though, I do not see the catalyst to send the market that high in the short term, but obviously will be paying close attention to the volatility in the market.